Kent Spencer

Province

Bob Dominick, vice-president of WestStone Properties, at a condo development in Surrey, says developers will be hard hit by the harmonized federal-provincial sales tax.

Builders and consumer groups say B.C.’s new harmonized sales tax is a “disaster” that will add $36,000 to the cost of a new $800,000 home.

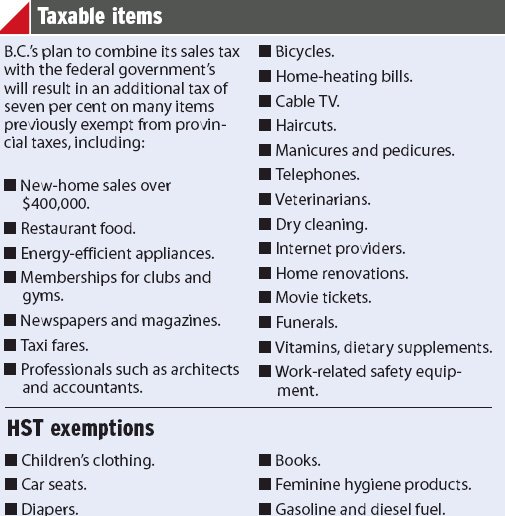

Opposition is building to the province’s plans to add a seven-per-cent levy on goods and services that had been exempt from provincial tax.

“My own company just survived one of the worst recessions in a long time. I would think twice about paying an extra $36,000 house tax,” Bob Dominick, vice-president of WestStone Properties, said Sunday.

“Developers are saying the industry is getting quite badly hit. This will not encourage people to buy homes,” said Dominick, whose company is a major developer in Surrey and Langley.

The tax will add seven per cent to the cost of everyday services such as haircuts, dry cleaning and accountants’ fees, which have previously included only the five-per-cent GST.

Other items include Internet services, telephones and movie tickets.

The province said last week that it would harmonize its provincial sales tax with the federal goods and services tax, effective July 1, 2010.

The seven-per- cent PST will be combined with the five-per-cent federal GST for a single, harmonized sales tax rate of 12 per cent.

Bruce Cran, president of the Consumers Association of Canada, called the plan a “total disaster.” “Our lines are filling up with calls from disgusted people,” Cran said. “Consumers are absolutely shocked. They don’t know where this is coming from.

“Another $30,000 or $40,000 is pretty much a killer for new housing.” Under the new tax, the levy on new homes will increase from five per cent to 12 per cent.

Rebates will be offered up to $20,000, or five per cent. Taking the rebate into consideration, the actual increase in tax on new homes will be two per cent on the first $400,000 and seven per cent thereafter.

Hence, the additional tax on a $400,000 new home will be $8,000. The additional cost for an $800,000 home will be $36,000.

The Liberal government told restaurateurs in writing during the recent provincial election campaign that it had “no plans” to consider implementing the HST.

NDP finance critic Bruce Ralston accused the government of lying.

“It is flat out and out deceit. They lied,” Ralston said. “That’s what outrages people. They’re pissed off.” The province says the construction industry will save $880 million, manufacturers $140 million and the transportation industry $210 million through harmonization.

Ralston doesn’t believe reduced costs for businesses will be passed along to consumers.

“People have learned economic theory does not match economic reality,” he said.

B.C. business groups support the move, including the B.C. Business Council, B.C. Progress Board and B.C. Chamber of Commerce.

The Canadian Taxpayers Federation said the tax will simplify a complicated system.

B.C. director Maureen Bader said small businesses will benefit as a result of being able to claim a credit on their PST.

She gave an example of an artist who will receive tax credits on additional work-related items.

“The artist can now deduct the full sales tax on everything to run a business, not just paints and brushes, but computers and chairs. It’s a big benefit,” she said.

“Anything that lowers the costs to businesses will ultimately be better for consumers.” But she conceded there will be “short-term” price increases.

Restaurant owners, who will see a seven-per-cent additional tax on food, predict an average $50,000 loss in sales per business.

“There’s no question we’re going to do something to bring more attention to the issue,” said Mark von Schellwitz, spokesman for the Canadian Restaurant and Foodservices Association. “It could be a consumers’ campaign, we haven’t decided.

“This tax can mean the difference between staying in business and closing up. It’s very bad news.”

© Copyright (c) The Province