HST could be a hurdle for buyers in a recovering market, they predict

Brian Morton

Sun

Homebuilders are worried that B.C.’s proposed harmonized sales tax will add significantly to the price of a new home, and perhaps slow down the real estate market’s signs of recovery.

Rob Grimm, co-owner of Richmond-based Portrait Homes, said in an interview that recent sales have picked up as buyers take advantage of lower real estate prices, but that the new tax — which will add a provincial sales tax to the federal goods and services tax on new homes, effective July 1, 2010 — might change that trend.

Like others in the homebuilding industry, he’s concerned the new tax will turn off buyers.

“Costs have come down, [and] we’ve had about 35 starts this year,” Grimm said of his company, which builds single-family homes. “Now, we’re going to reverse that. It doesn’t make sense.”

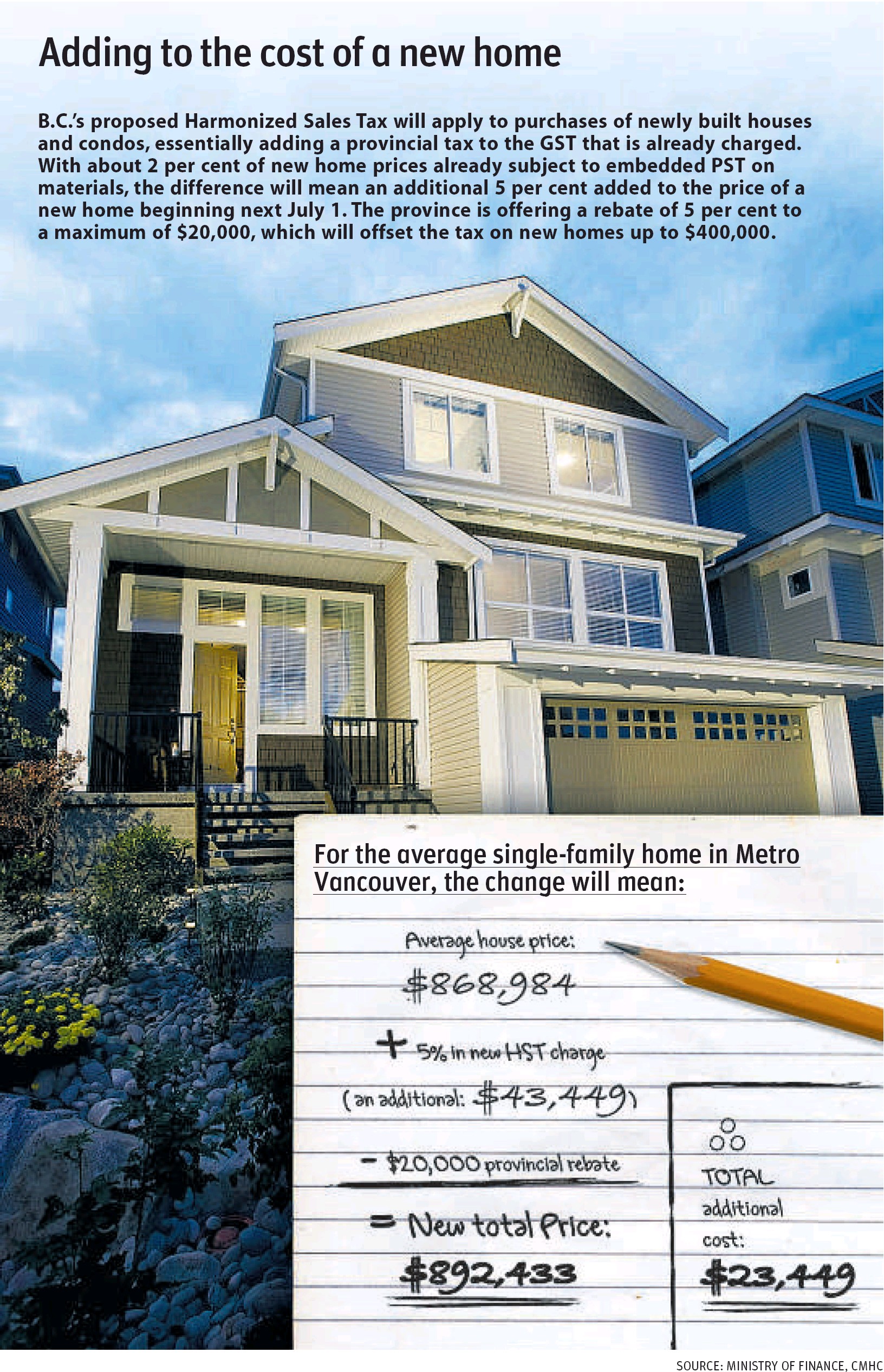

Under the plan, a previous exemption from the provincial sales tax for new homes will disappear, resulting in an extra seven-per-cent tax. As some of that tax was already built into prices because it covered things such as building materials, the effective tax rate will climb about five per cent, according to the B.C. Ministry of Finance.

The new plan will offer a five-per-cent rebate of the provincial portion of the single tax, but only up to a maximum of $20,000, which will ensure that new homes up to $400,000 will bear no more tax than under the current tax regime.

Buyers of new homes over $400,000 will still receive the maximum rebate of $20,000, but will see the purchase price above that level subject to the extra five-per-cent tax rate.

The tax harmonization also applies to such things as fees for lawyers and notaries public, but these are already subject to the provincial sales tax so should not result in additional expense.

Grimm said he’s still not sure exactly how much extra buyers will end up paying, only that he believes it will be significant.

“I haven’t done the calculation yet, but it will add a lot to the bottom line of a house.”

Grimm said there was no consultation with industry by the government.

“Unfortunately, the government thinks the homebuilding industry can be targeted because purchasers don’t know about all the taxes and fees. I’m very disappointed in this. It’s absolutely stupid. Home building and home sales drive a lot of the economy.”

Greater Vancouver Home Builders’ Association chief executive Peter Simpson said the new tax will significantly increase the cost of buying a new home, although he couldn’t provide numbers.

“We’re seeing marginal improvement and sales increases. But this plan will place another impediment in front of the people, and we don’t need an impediment at this time.”

Simpson said he believes there’s room for flexibility on the part of the government.

Scott Russell, president of the Real Estate Board of Greater Vancouver, said he did not yet know all the implications of the new tax, only that it will result in a big price increase for buyers.

“We certainly feel it will affect the buying public. We’re definitely opposed to it.”

Meanwhile, Keith Sashaw, president of the Vancouver Regional Construction Association, which deals mainly with non-residential construction, said he believes the new HST will result in a lot less paperwork.

“On the non-residential side, we’re supportive of a harmonized sales tax,” Sashaw said.

© Copyright (c) The Vancouver Sun