KEVIN CARMICHAEL

Other

Bank of Canada Governor Mark Carney (Adrian Wyld/The Canadian Press

OTTAWA – The Bank of Canada cut its benchmark lending rate to within spitting distance of zero, and signalled that it is prepared to increase the money supply to spark a rebound that policy makers acknowledged could be farther off than they first thought.

As most economists expected, the central bank cut its overnight lending rate by half a percentage point to 0.5 per cent, the lowest ever, prompting the country’s biggest lenders to quickly match, dropping their prime rates to 2.5 per cent.

The surprise in Tuesday’s statement was the declaration that Governor Mark Carney and his advisers on the governing council are preparing the ground for a program of “credit and quantitative easing.”

Such an effort would pump money into Canada‘s financial system by giving banks and others a new buyer for assets such as government bonds and corporate debt. The Bank of Canada’s current credit-market programs are different because they only offer short-term loans, taking banks’ paper assets as collateral.

The Bank of Japan already is buying company debt, and the U.S. Federal Reserve and the Bank of England are considering similar plans because some markets for credit remain unusually tight more than a year into the financial crisis.

“Given the low level of the target for the overnight rate, the bank is refining the approach it would take to provide additional monetary stimulus, if required, through credit and quantitative easing,” the Bank of Canada said in a statement.

The central bank declined to provide further details, saying it will “outline a framework for possible use of such measures” when it publishes its next quarterly report on economic conditions on April 23.

A program of quantitative easing would take Mr. Carney into unchartered territory, as such measures, which risk stoking runaway inflation, have never been tried in Canada.

“Simply put, the bank is preparing to pull out all the stops to support the economy,” Doug Porter, an economist at BMO Nesbitt Burns in Toronto, said in a note to clients.

Mr. Carney is struggling to reverse Canada‘s first recession in almost two decades. The collapse of the market for U.S. subprime loans more than a year ago sparked a global financial crisis that is now shrinking the economies of the world’s richest countries.

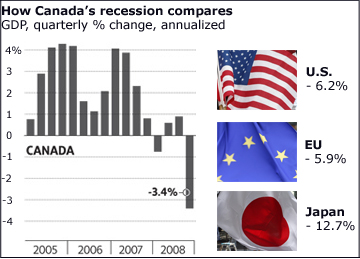

Statistics Canada reported Monday that gross domestic product declined at an annual rate of 3.4 per cent in the fourth quarter, the biggest contraction since 1991 and worse than the 2.3 per cent rate of decline that the Bank of Canada predicted in January.

“While this played to the script of the Bank of Canada’s forecast, the miss on their fourth-quarter growth rate projection will leave the economy even more battered-and-bruised than they anticipated and justified their actions today,” Dawn Desjardins, assistant chief economist at the Royal Bank of Canada, said in a note for clients.

In its statement, the central bank acknowledged that economic growth through the first half of the year will be weaker than it expected, noting that the “output gap” – the difference between current economic activity and the pace policy makers reckon the economy can set without stoking inflation – is wider now than it was at the start of the year.

“Potential delays in stabilizing the global financial system, along with the larger-than-anticipated confidence and wealth effects on domestic demand, could mean that the output gap will not begin to close until early 2010,” the statement said.

That will keep inflation “slightly lower” in the months ahead than originally thought, policy makers said in the statement.

As a result, Mr. Carney likely will keep borrowing costs low for some time.

The central bank aims to keep inflation advancing at an annual rate of about 2 per cent. In its January forecast, the Bank of Canada estimated the annual inflation rate would be 1.2 per cent this quarter and that prices would decrease in the second and third quarters.

“Consistent with returning total [consumer price index] inflation to 2 per cent, the target for the overnight rate can be expected to remain at this level or lower at least until there are clear signs that excess supply in the economy is being taken up,” policy makers said in the press release explaining their decision.

Because so much of Canada‘s wealth comes from exports, the central bank said a rebound will depend heavily on the efforts of U.S. President Barack Obama to stabilize the world’s largest economy.

The Obama administration is spending hundreds of billions in an effort to stimulate demand and buttress some of the world’s largest banks, which teeter on the edge of insolvency.

The Bank of Canada wasn’t all negative today.

Policy makers said in the statement the Canada‘s economy should rebound faster than that of other nations once the extraordinary stimulus from governments and central banks kicks in.

The United States economy contracted at a 6.2 per cent over the same period. The European Union’s GDP reversed at a 5.9 per cent pace and Japan‘s economy collapsed at a 12.7 per cent pace.

Mr. Carney has slashed the benchmark lending rate by 4 percentage points since December, 2007, to buoy spending in Canada and loosen credit markets.

Interest rate cuts act with a lag. The central bank said Monday that its efforts over the past year will begin show up in the second half of the year and into 2010.

“Once the global financial system stabilizes and global growth recovers, the underlying strength of the Canadian economy and financial sector should ensure a more rapid recovery in Canada than in most other industrialized nations,” the Bank of Canada said.