A few more buyers are dipping into the market, but analyst predicts continued slide in prices

Derrick Penner

Sun

As of February, Lower Mainland housing prices were about halfway to the bottom of their expected down-cycle, a Canada Mortgage and Housing Corp. analyst said Tuesday.

Both the region’s major real estate boards reported February sales figures Tuesday showing continued low sales levels similar to those experienced in the early 1980s, although transactions did surpass the dismal lows experienced in January of this year.

“Overall, we’re looking for a 24-per-cent decline,” Robyn Adamache, Canada Mortgage and Housing’s senior analyst for the region said in an interview.

“We have seen prices trending down since spring of last year, and are about 12 to 13 per cent down depending on what type of property you’re looking at. So if we’re looking for 24 per cent, we’re about halfway there.”

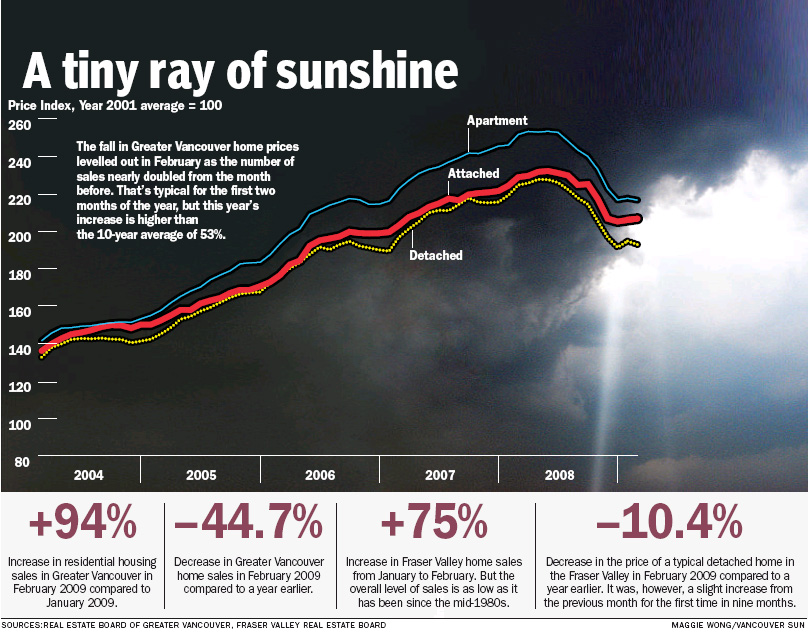

The so-called benchmark price for a typical detached home in most of Greater Vancouver hit $653,342 in February, down about 14 per cent from the same month a year ago, the Real Estate Board of Greater Vancouver reported.

That benchmark was generated from 1,480 Multiple-Listing-Service (MLS) registered sales recorded within the board’s region, which includes the Sunshine Coast and Squamish, but excludes Surrey.

Those sales were about 45 per cent below the same month a year ago, but almost twice January’s 762 transactions.

In the Fraser Valley, the benchmark price for a detached home was down just over 10 per cent from the same month a year ago to $456,683, though that was slightly higher than January’s $452,145 benchmark.

Fraser Valley realtors saw 682 sales in February, which was 48 per cent lower than the same month a year ago, according to figures from the Fraser Valley Real Estate Board.

However, it was 75 per cent higher than January’s sales.

Adamache said February’s jump in sales represents “a pretty normal seasonal trend,” and not one she would see as heralding a dramatic turnaround.

However, the level of sales compared to a year ago seems to indicate that the rate of sales decline is slowing, Tsur Somerville, director of the centre for urban economics and real estate at the Sauder School of Business at the University of B.C., said in an interview.

“To some extent, it looks like the rate of [sales] decline has really peaked and as we go into summer, things will only be down a little bit, or will have stabilized,” Somerville said. “[That is] not presupposing that stuff doesn’t get really bad in the economy.”

Somerville added that housing markets tend to be a leading indicator of the economy, so “the housing market gets worse before the economic numbers turn down,” and vice versa.

In that respect, Somerville said B.C. likely hasn’t seen the end of its economic downturn, and as it does, “a plateau [in sales] is a lot more likely than a bounce-back.”

Both major real estate boards, however, reported higher traffic at open houses compared to the standstill of last fall, when news of the world financial crisis first hit.

Watt said the major mortgage lenders all report having pools of pre-approved potential buyers who “from a pure lack of confidence, are still sitting on the fence.”

However, Watt said a larger group of potential buyers seem to believe that while they don’t think prices have reached “whatever bottom they’re going to reach, they’re comfortable that the price adjustment was adequate for them to become more interested, and the cost of borrowing is down about 25 per cent in terms of actual payments.”

© Copyright (c) The Vancouver Sun