USA Today

WASHINGTON (AP) — Sales of existing homes rose 3.1% in July from June as buyers snapped up deeply discounted properties in parts of the country hit hardest by the housing bust, the National Association of Realtors said Monday.

But the number of unsold properties hit an all-time high, latest indication that the worst housing slump in decades is far from over.

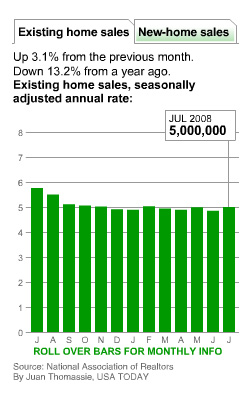

The National Association of Realtors reported Monday that sales rose to a seasonally adjusted annual rate of 5 million units. Sales had been expected to rise only 1.6%, according to economists surveyed by Thomson/IFR.

Home sales were 13.2% lower than a year ago and prices were down dramatically. The median price for a home sold in July dropped to $212,000, down 7.1% from a year ago.

Despite the third monthly sales jump this year, the number of unsold single-family homes and condominiums rose to 4.67 million, most since 1968, when the Realtors group started tracking the data.

That represented an 11.2-month supply at the July sales pace, matching the all-time high set in April.

Sales were up in all regions except the South, which posted a 0.5% decline. Sales rose 5.9% in the Northeast, 0.9% in the Midwest and 9.7% in the West.

Analysts say until inventory is reduced to more normal levels, the housing slump is likely to persist. The inventory is being driven higher by a wave of mortgage foreclosures.

Despite the rise in sales, Lawrence Yun, the Realtors’ chief economist, was reluctant to conclude that the housing market has hit bottom.

While buyers are pouncing on lower prices — especially in places like California, Florida and Nevada — sales are sluggish in formerly stable states like Texas.

“People are responding to lower prices,” Yun said, but there is “too much uncertainty” about the housing market’s future to call a bottom.

One key unknown is the ability of mortgage finance companies Fannie Mae and Freddie Mac to supply money for loans. The two companies have cut back the availability of mortgages significantly as they cope with mounting losses from foreclosures and government officials stand by to shore up the two struggling companies if needed.

President Bush last month signed housing legislation that aims to prevent foreclosures by allowing an estimated 400,000 homeowners to swap their mortgages for more affordable loans, but only if their lender agrees to take a loss on the initial loan.

Even with government help, nearly 2.8 million U.S. households will either face foreclosure, turn over their homes to their lender or sell the properties for less than their mortgage’s value by the end of next year, predicts Moody’s Economy.com.

Copyright 2008 The Associated Press. All rights reserved.