At 3%, downtown Vancouver has tighter market than booming Calgary

Derrick Penner

Sun

Vancouver‘s downtown office vacancy rate shrunk to a new low of three per cent, inching past Calgary as the tightest central office market in the country, according to commercial realtor CB Richard Ellis.

Only 645,008 square feet of Vancouver‘s 21.6 million square feet of offices downtown sit vacant, according to CB Richard Ellis’ third-quarter report.

CB Richard Ellis analyst Chris Clibbon added that downtown’s vacancy “is probably one of the lowest in North America,” when it comes to downtown office availability.

Clibbon added that the opening of the 11-storey, 238,000-square-foot expansion of the Bentall Five building on Burrard Street will create some flex in the market.

“There are tenants giving back some large chunks of space,” he said.

“Some will be moving into Bentall Five . . . and there will be some tenant shifts creating some options here and there, but nothing substantial.”

Jeffrey Rank, managing director of commercial realtor Cushman & Wakefield LePage, said the subleasing market has provided some relief for the downtown market, providing room for tenants as companies change locations.

Catalyst Paper Corp.’s planned move from the PricewaterhouseCoopers building at 250 Howe St. to a suburban headquarters that will empty three floors in the downtown building is one example of office space opening up.

However, that space in the PricewaterhouseCoopers building was almost immediately leased by existing tenants in the building.

“In some markets, one of which I think we’re in right now, looking at purely the percentage numbers doesn’t always tell you the whole story,” Rank said.

“Still, we’re in a tight market. There’s no question [about that].”

Cushman & Wakefield’s assessment of downtown’s vacancy is slightly higher than its competitor at 3.9 per cent.

Clibbon said Catalyst’s decision to move out of downtown is indicative of another trend market analysts expect to see as vacancy remains tight.

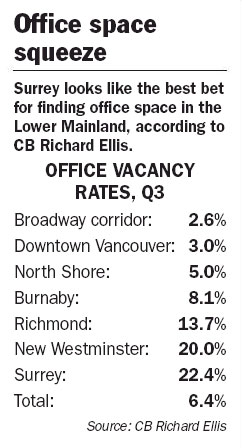

Suburban office vacancy, according to CB Richard Ellis, was 10.9 per cent across all markets, although the total office space in the remainder of Metro Vancouver is only 17.3 million square feet. By community, vacancy ranged from 8.1 per cent in Burnaby to 22.4 per cent in Surrey.

Meanwhile, half of all new office buildings — some five-million square feet — being built in Canada are going up in Calgary, which will dramatically change its vacancy picture. That city’s vacancy rate crept up to 3.1 per cent in the third quarter compared with 2.8 per cent in the second quarter.

Nationally, the vacancy rate for Class A space in the third quarter dipped to an “extremely low” 4.7 per cent, with rents climbing to an average $21.99 per square foot compared with $20.84 a quarter ago, according to CB Richard Ellis.

Montreal was the only market with falling prices. Asking rents dropped to $18.09 per square foot per year from $18.83.

“Even with the addition of a sizable amount of new Class A office space, the Calgary market will still be relatively tight market for some tenants because much of the new space coming to the market has already been leased,” said CB Richard Ellis president Blake Hutcheson.

© The Vancouver Sun 2007