Market is being driven by aging baby boomers who want to spend their money on quality of life

Michael Kane

Sun

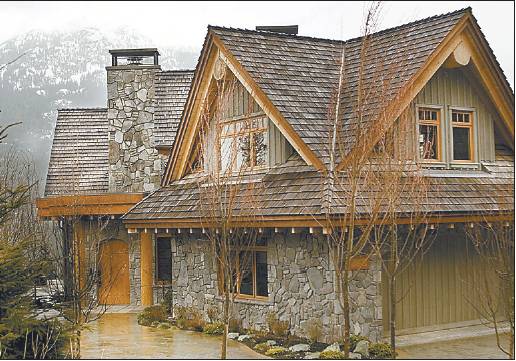

BONNY MAKAREWICZ/SPECIAL TO THE VANCOUVER SUN $12.5 MILLION GETAWAY CABIN: This 4,800 sq.ft. craftsman luxury home in Whistler’s Taluswood neighborhood is currently listed for $12.5 million.

Executives are paying $1 million-plus for waterfront homes. Photograph by : Mark van Manen, Vancouver Sun Files

Aging baby boomers are fuelling an unprecedented demand for recreational property, even in British Columbia, which has the most expensive recreational homes in the country.

Foreigners and Alberta oil executives are paying $1 million-plus for winterized waterfront homes on Saltspring Island, Shuswap Lake and Kelowna, while middle-income earners are settling for condos or back-lot properties with waterfront access, or more affordable locations like Harrison Lake in the Fraser Valley or the Interlakes area of the Cariboo.

The market is being driven by aging boomers who are earning good money and want to spend it on quality of life rather than mutual funds, said Elton Ash, Kelowna-based vice-president of Re/Max of Western Canada.

“The whole economy is clicking very well but there is also the trend to longer hours, stresses at work, and the kids being dropped off at daycare, so quality of life becomes very important,” Ash said in an interview.

“People know the stock market has recovered and there are some opportunities there but they are saying, ‘How does that improve my quality of life when the kids hardly see me? I want to give them the experience I had as a child growing up and going outdoors and spending the weekends and holidays as a family’.”

The Re/Max Recreational Property report released Thursday shows that buyers aged 50-plus are fuelling unprecedented demand in 27 of 40 markets surveyed across the country.

Some boomers are inheriting the money to buy a second home while others, with good incomes and job security, are taking out mortgages, Ash said. To a lesser extent, artisans and high-tech workers, who don’t need to be in the office, are selling up in the city and making their year-round homes in places like Saltspring.

Early retirees who are “trading down” are also a segment of the market in places like the Okanagan, Saltspring, Vancouver Island and Nelson, he said.

While volume demand for recreational property is coming from middle-income earners, they have been priced out of the most expensive markets like Whistler where the starting price for a typical, three-bedroom home off the mountain is $1.1 million and homes on the waterfront and ski slopes start at $2.5 million and $3 million respectively.

“You are not going to get much of a house, as we think of a house, for much less than $1.1 million,” said Whistler realtor Mike Wintemute of Re/Max Sea to Sky Real Estate. “You can buy a house in Emerald Estates [on the outskirts] for about $700,000 but you’re basically getting an old cottage.”

On Saltspring, about 70 per cent of big ticket buyers are Americans and 20 per cent are Canadians, mostly from Alberta, said Re/Max realtor Li Read. To a lesser extent, wealthy Europeans, Asians and Australians are also buying second, third and fourth residences to support their globe-trotting lifestyles.

In another sign of a booming domestic economy, the report says teardown activity is rampant in most areas of the country as baby boomers construct year-round lakeside dwellings with all the comforts of home. Renovation is also occurring at full-tilt in markets across the country.

Ash said boomers aren’t too concerned that the market might fall back in a year or two because they are buying for the long term.

“They know prices aren’t going to get significantly cheaper and they are looking for the opportunity to enhance their family lifestyle today and to leave a bit of a legacy for their children to enjoy.”

© The Vancouver Sun 2006