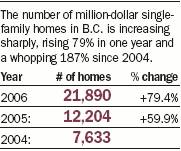

Nearly 22,000 B.C. houses are now worth more than a million dollars

Fiona Anderson

Sun

Source: B.C. Assessment. VANCOUVER SUN Soaring values

B.C.’s surging home market has nearly doubled the number of real estate millionaires in the past year with 22,000 single-family dwellings now assessed at more than $1 million.

The massive increase in real-estate wealth comes mainly from rising prices fuelled by a booming market and a strong economy.

“The main drivers [behind the increases] are the great economy, job growth, population growth, consumer confidence and mortgage and interest rates [which] are still low from a historic perspective,” Cameron Muir, senior market analyst with Canada Mortgage and Housing Corporation said in an interview.

“It’s no surprise, given the ramp-up in prices over the last two years.”

It’s unlikely that trend is going to change soon, Muir said. As long as demand for housing outstrips supply, prices are going to continue to rise, he said.

The largest concentration of real-estate millionaires continued to be in Vancouver, but the biggest increases were outside the city and in many cases outside the Lower Mainland.

The 2006 assessment roll, which is based on values calculated on July 1, 2005, lists 21,890 single-family detached homes as being worth more than $1 million, up 79.4 per cent from 12,204 on the 2005 assessment roll, and up 187 per cent from the 7,633 million-dollar homes assessed for 2004.

Vancouver was home to 8,270 single-family dwellings that reached the million-dollar mark, up 64 per cent from last year’s 5,056. That number does not include the numerous high-end condominiums in downtown Vancouver that have sold for well over $1 million.

Throughout the province, Whistler experienced the only decrease in million-dollar home- owners, falling slightly from 1,055 in 2005 to 1,043, the second year in a row the resort town saw a drop.

In Langley, the number of million-dollar homes increased more than 45-fold from six to 276, and in rural Courtenay on Vancouver Island there were 59 homes in the million-plus range where there were none a year ago.

In Langley, land value is pushing up prices, said David Rishel, president of the Fraser Valley Real Estate Board.

For example, the average home on a parcel of land in Langley that is half an acre or more was $982,000 in March, Rishel said.

“So it doesn’t have to take a whole lot,” Rishel said. “If the prices in general are going up 17 per cent there are a bunch more homes that are going to be over the $1 million-price range.”

Langley has typically been a rural community and it’s just in the past three or four years that it has exploded as far as residential development is concerned and that drives those land values, Rishel added.

“I’ve been in this business for more than 20 years and I remember almost every year saying, “How can prices go up any more than what they are right now?” But it just continues to always go up,” Rishel said.

In the Courtenay area, the big jump in million-dollar homes is with waterfront property, said Marty Douglas, managing broker with Coast Realty Group in the Comox Valley.

Courtenay has become more accessible because of the new Island Highway, which makes Nanaimo only 30 minutes away, and because of direct flights from Alberta to Comox, Douglas said.

This ease of access is prompting people from Alberta, Victoria and the Lower Mainland to migrate to the area, driving up prices. That means locals can afford to sell their homes and buy something bigger or better themselves, he said.

“People are saying “okay we’ve got our equity out and we can finally afford our dream home or waterfront.”

“So, just as people from Calgary and Victoria have been migrating to the Comox Valley, people from the municipalities in the Comox Valley have been moving out or just buying for investment.”

The B.C. Assessment Authority assesses properties each year based on market value.

John Barry, Assessment Authority community relations manager, said the jump in million-dollar homes reflects market increases, particularly in waterfront properties.

Does the sudden increase in real estate wealth mean a sudden jump in taxes?

The Assessment Authority provides these figures to municipalities, which use the information to determine their tax or mill rate based on how much money they need to raise.

It all comes down to what local governments must budget for, and in some cases municipalities could lower the mill rate and taxes could decrease, Barry said.

“Just because their assessed value has increased, it doesn’t necessarily mean their tax will go up,” he said.

© The Vancouver Sun 2006