Derrick Penner

Sun

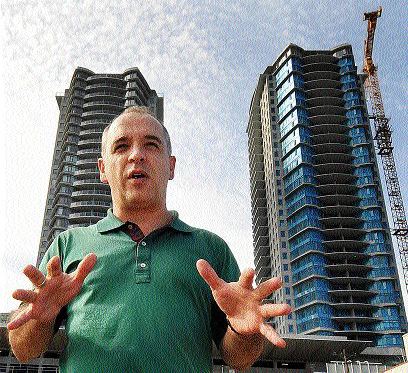

Tony Gioventu, executive director of Condominium Homeowners Association of B.C., talks about the expected impact of the HST. He said strata fees will rise from three to seven per cent next year. Photograph by: Steve Bosch, Vancouver Sun

British Columbia‘s condominium owners can expect their building maintenance fees to rise up to seven per cent when the Harmonized Sales Tax (HST) takes effect next July, according to groups that represent them.

Monthly maintenance fees cover the common costs of looking after a condominium complex, from landscaping and janitorial to heating systems and elevator maintenance.

All services now subject only to the five-per-cent GST will be subject to the full 12-per-cent HST after next July 1.

“The potential here is that strata corporation budgets and fees are going to be raised anywhere from three to seven per cent to cover costs,” Tony Gioventu, executive director of the Condominium Homeowners Association of B.C., said in an interview.

“The consumer is going to pay those bills.”

Gioventu said the strata-corporations’ tax picture is still a little unclear since the province has not yet brought forward its legislation to harmonize the GST with the provincial sales tax.

His organization is in discussions with the provincial Ministry of Finance and Canada Revenue Agency to find out exactly what the HST will apply to.

He said the added tax burden will vary from condominium complex to complex, depending on how much the governing strata corporations rely on contractors to provide services.

Gioventu said some smaller strata corporations manage their own affairs among the condominium owners, and have few needs for outside services.

Most, however, hire property management firms, and even those companies’ fees will go from being subject only to the GST to being subject to the additional amount of the HST.

“Strata corporations are end users, so they have no input tax credit system or GST rebate at the present time,” said Kevin Thom, executive director of the Strata Property Agents of B.C., an organization that represents about 90 of B.C.’s 289 registered strata property managers.

Thom said bigger complexes, such as highrises with underground parking, elevators, swimming pools and extensive mechanical systems can require a lot of services.

Anybody providing services to strata corporations “would obviously have to increase their fees, including management companies,” he said.

Thom said it is also debatable whether strata corporations would want to press the provincial Ministry of Finance and the Canada Revenue Agency to give them some sort of tax credit or HST exemption to claim back the tax if it means a re-examination of their non-taxable status.

Most condominium owners are unaware of how the HST will hit their fees right now, Thom said, but the picture will become clearer once management firms start giving strata corporations their budgets for next year.

Gioventu said that how much the HST hits condominium owners will also depend on how much service suppliers can accommodate the impact of the tax in their fees.

“The service providers will be the ones that get [HST credits], so will they accommodate those increases in their pricing to offset [the tax]?” Gioventu asked. “That’s the really big question.”

© Copyright (c) The Vancouver Sun