David Baines

Sun

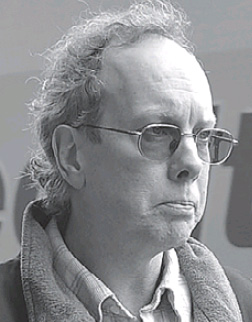

Martin Wirick Photograph by: Ward Perrin, Vancouver Sun

Tarsem Gill Photograph by: Ward Perrin, Vancouver Sun

Former Vancouver lawyer Martin Wirick and real estate developer Tarsem Gill have elected to be tried by judge and jury on charges that they defrauded lenders out of more than $30 million.

The two men appeared briefly Monday before Vancouver Provincial Court Judge Joseph Galati with their high-profile lawyers, Richard Peck for Wirick and David Crossin for Gill, to make the election. Appearing for the Crown was veteran prosecutor Kevin Gillett.

Wirick, tall and gaunt, was dressed in a rumpled black nylon jacket and dark blue pants. Gill was also casually dressed in a windbreaker, khaki pants and running shoes. Neither man said anything in court.

Crossin requested a preliminary hearing, which he estimated would take eight days. He said the hearing “won’t necessarily be a full preliminary,” suggesting it will focus on certain issues.

The judge asked the parties to return to court on Thursday to set a date for the hearing. Due to scheduling conflicts with the various lawyers, it may be many months before it is held.

In August, Wirick and Gill were charged with two counts of fraud and theft against 77 different homeowners, and two counts of fraud and theft against lenders in 30 different loan transactions. Wirick was also charged with two counts of uttering false documents and Gill with one count of possession of stolen property.

The total amount of money alleged to have been unlawfully taken from homeowners and lenders exceeds $30 million.

The B.C. Law Society has already deemed that a fraud has occurred. Its special compensation fund, which insures clients for lawyer fraud, has paid out $38.4 million in claims on account of Wirick’s dealings on behalf of his client Gill. Whether their conduct amounts to criminal fraud will be determined by the court.

Gill’s method of operation, as described in the law society’s Benchers’ Bulletin, was to develop a property and sell it to one of his nominees. The nominee would arrange a mortgage on the property and then sell it to an innocent purchaser.

The purchaser, in turn, would arrange financing from his lending institution and forward the money to Wirick on his undertaking to pay off the original mortgage loan and register a new first mortgage. But rather than disburse the money as promised, Wirick simply paid the funds to Gill and his Vanview group of companies.

In many cases, Wirick would provide false discharge documents, and a portion of the purloined money would be used to keep the original mortgage payments current, so neither the purchaser nor the original mortgage lender would be any wiser.

The new mortgage lender, meanwhile, naturally assumed he had obtained a first mortgage against the property. But since the original mortgage hadn’t really been discharged, he was actually in second position.

In some cases, this process was repeated, enabling Gill to mortgage the property many times over and generate more money than it was worth. Eventually the scheme collapsed, revealing a tangled web of transactions, mortgages and competing claims.

When the scheme was uncovered in May 2002, law society officials took over Wirick’s practice and audited his books and records. They found that, from January 1998 to May 2002, $52.7 million passed through Wirick’s trust accounts to Gill and his companies.

Of this amount, $32.6 million was used for development and construction costs; $12.5 million was paid to lending institutions to keep mortgages up to date, including those that should have been discharged; $3.2 million was paid to Gill and related parties and only $600,000 to Wirick.

After the scheme was discovered, Wirick resigned from the society and subsequently declared bankruptcy. Since then he has been working at KoKo’s Gourmet Pet Food in North Vancouver. Gill has continued to develop properties in the Vancouver area.

© Copyright (c) The Vancouver Sun