Is now the time to plunge into the U.S. housing market?

Sarah Dougherty

Sun

A foreclosed home is up for sale in Altadena, Calif. Some Canadians are taking advantage of falling house prices in the U.S. and the strong Canadian dollar by buying a second home south of the border. Photograph by : David McNew, Getty Images

Just four years ago, with the Canadian dollar at a lowly 85 cents against the American dollar, Canadians winced at even shopping across the border.

But with our currency riding high, we’re no longer feeling like the poor cousins. Now, even buying a vacation home or investment property in the U.S. seems within reach.

And the stars are lining up for Canadian buyers in other ways: the collapse of the U.S. housing market has led to steep drops in home prices in prime locations like Florida.

But is now the time to buy? Real estate agents say yes, but others familiar with pitfalls of buying in the U.S. recommend proceeding with caution.

Marc Rasmussen is a realtor with SKY Sotheby’s International Realty specializing in properties in and around Sarasota, on Florida‘s western Gulf of Mexico coast.

He’s seen a jump in interest among international buyers. “There’s a lot of activity from Canada and Europe because of the strength of the currencies,” he said.

“The values of properties have come down 35 per cent, maybe even 40 per cent from the highs of 2005,” Rasmussen said of single-family homes and condos in his market. “In conjunction with the weak currency, it’s a pretty good time to be a buyer.”

While the prices of properties on the bays and beaches did not decline as much, they still took a hit, he added.

But in recent months, the inventory of homes for sale has declined and prices seem to have bottomed out, according to Rasmussen. For buyers in it for the longer haul and not a quick flip, now is the time to take the plunge, he said.

Over on Florida‘s east coast, realtor Kimberly Kirschner agrees prices are close to hitting bottom. Her firm, Kirschner Realty International Inc. in Hollywood, north of Miami, is targeting buyers not only from Canada, but also Europe, Britain and South America.

Kirschner has been busy attending international trade shows and says media coverage of the woes of the U.S. housing market in other countries is attracting foreign buyers. Prices in Kirschner’s area are running 20 to 40 per cent below appraised value after a frenzy of speculative buying a few years back.

“There was an awful lot of speculation at the height of the market,” said Kirschner. “A lot of them (speculative buyers) took risky loans, then couldn’t flip out fast enough when their interest rates were reset.”

Recently, sales have picked up and Kirschner thinks prices of sought-after waterfront homes will be the first to recover, making this the prime time to jump in.

But the Canadian Snowbirds Association, a lobby and information group for people spending significant time down south each year, is raising a red flag about buying in Florida, the winter home of three-quarters of its members.

The state has a two-tiered property tax system that caps the assessed values of homes of residents, but lets values rise for non-residents. Despite a recently introduced cap for non-residents, the gap between the two tax rates is significant. (Florida is the only state with this type of system, according to the Association.)

“People are very excited about the sub-prime mortgage fiasco,” said Lawrence Barker, the Association’s executive director. “But we are cautioning people about buying in Florida because of the two-tiered property-tax issue.”

Other states, like Arizona, are starting to market to Canadians to “poach” some snowbirds away from Florida, according to the Association.

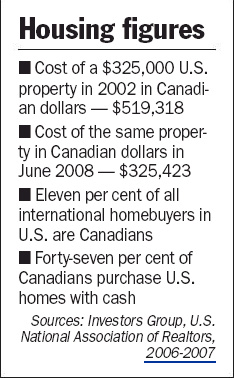

Tannis Dawson has also seen an uptick in people asking about buying properties in the U.S., especially in California, Arizona, Las Vegas and Florida. She’s a senior tax and estate planning specialist with Investors Group in Winnipeg.

Dawson counsels clients to test the waters before buying. “I suggest they look at whether renting is better than buying,” she said. “That way they can try a few places out.”

She also advises clients about mitigating their currency fluctuation risk. “You’re paying in U.S. dollars but your sources of income are in Canadian dollars,” she said. “What if our currency goes down?”

One strategy is to re-mortgage a Canadian home or take out a line of credit to help pay for a U.S. home. “That way your debt is in Canadian dollars,” Dawson explained.

Canadians should also know that, as non-residents, they face stiffer mortgage requirements than Americans, said Dawson. (It’s not possible to get a Canadian mortgage on a U.S. property, she said.)

Many banks, for example, will ask for a 30 to 40 per cent down payment, plus a six-month reserve to cover a chunk of mortgage payments and property taxes.

Once you buy a property, rules about residency and taxes kick in, Dawson said. Roughly speaking, if you spend 183 days or more in the U.S., you may be deemed to be a resident and liable for U.S. taxes on your worldwide income and assets.

There are some exceptions to this rule, but even non-residents must pay taxes on rental income from a U.S. property and on the proceeds of any sale.

And if you happen to be in the path of a tornado, flood or other natural disaster, don’t expect the government to help: Disaster relief in the U.S. is not available for vacation properties, only primary residences.

© The Vancouver Sun 2008