Every time a modest commercial block falls to a condo tower, the city budget suffers

Don Cayo

Sun

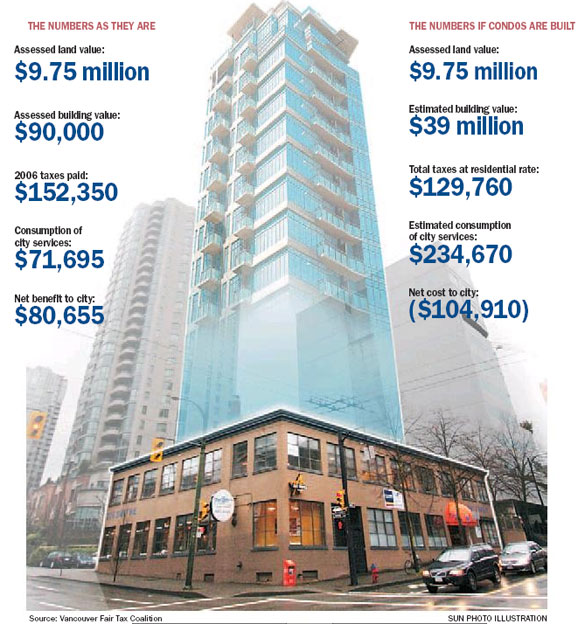

This two-storey Brodie Brush Building at 225 Smithe in downtown Vancouver generates $152,350 in annual tax revenues for the City of Vancouver, but uses just $71,695 in municipal services. If one were to imagine thatt it was replaced with a glitzy Yaletown residential tower, the city would lose $1,000 to $1,500 on every condo unit built. Photograph by : Glenn Baglo/Vancouver Sun

This year’s property tax bill for the old Brodie Brush Building at Cambie and Smithe will likely be twice as much as the building is worth — not counting its underlying land.

The bill will be split among four tenants. Last year, the portion paid by the largest of them, Art Works Gallery, exceeded $60,000. That’s more than three times what gallery owner Deanna Geisheimer paid in tax for the same space 10 years ago, and a lot more than her annual rent.

This year’s tax bills haven’t been sent out yet, but Geisheimer fears she’ll be clobbered again. The plain, two-storey former factory that houses her business squats amid a forest of glitzy glass condo towers, and this year the assessed value of the land shot up 50 per cent — a far bigger jump than ever before. It now stands at almost $10 million, or 110 times the building’s value.

Other businesses have been hit as hard by what many Vancouver business people see as an unrelenting assault from city hall. Since last summer, 42 businesses have folded or fled from the five-block Yaletown Heritage Area, and half the premises they used to occupy have no new tenant.

Yaletown is particularly hard-hit because of its astronomical land values, but the sting is being felt in every neighbourhood.

Over on Burrard, not far from the bridge, Henry von Tiesenhausen of Commercial Electronics notes that, in a five-year period when the tax on his home increased 16 per cent (and when his company’s sales were flat) his business taxes rose 102 per cent.

“I have to ask the question,” von Tiesenhausen said in a letter to Mayor Sam Sullivan, “is it worthwhile even operating a business in the City of Vancouver?”

A growing number seem to be asking the same thing — and answering in a way no one wants to hear. While commercial growth in the city has long trailed residential, the last two years have seen a disturbing new trend. For the first time, more businesses closed than opened.

All this says something is broken and needs to be fixed.

As I see it, it’s not just one problem, but three:

First, Vancouver’s success in building vibrant, high-density neighbourhoods has come with high hidden costs that nobody at city hall seems to have a handle on. The policies that drive the transformation from commerce to condos need to be rethought with an eye to how to stop losing money on every new tower.

Secondly, it is not fair that business property is assessed by one standard yet taxed according to another. This invites aberrations like the bizarre levy on the Brodie Building. The city justifies tax increases with the logic that at least the owner has an ever-more valuable asset, but this is not the case for business owners, who usually rent.

Thirdly, the total tax burden on businesses is way out of whack. They pay far more than the cost of the services they consume, while home-owners pay far less.

A soaring tax base

How does a prospering city — one experiencing not only an explosion in land values, but also a great deal of new construction that adds hugely to its tax base — get into such mess? It’s easy to see how a soaring real estate market might make it too costly for some businesses to hang on to the sites they occupy, but why do taxes go up so much faster than market-driven prices?

After all, every time a ho-hum commercial block falls to the wrecker’s ball and a condo tower rises from the rubble, the city’s tax base shoots up. A building worth a few tens of thousands is typically replaced by one worth tens of millions, enlarging the base for the city to tax.

It takes some head-scratching to understand it, but this kind of development — something that happens all the time — actually produces a brutal hit to the city budget. It results in your tax bill and mine inching up once again, while the city’s remaining business properties get clobbered.

In the last 15 years, Vancouver has added well over 40,000 new homes, mainly condos or townhouses. A great many of them were built where a business used to be. So the hits on your tax bill really add up.

Indeed, every new condo unit built in the city today will shift $1,000-$1,500 of annual costs to other taxpayers, according to the careful calculations of Paul Sullivan, a property tax specialist with Burgess Cawley Sullivan and Associates, and the technical co-chairman of the Vancouver Fair Tax Coalition.

Sullivan reckons that each new condo unit shifts 30-40 cents of extra tax to each of the city’s 153,000 homeowners, and 13 times that much — $4 or $5 — to each of the 14,000 commercial properties. (The average commercial assessment is just under $1.2 million, or not quite 21/2 times the average home.)

To understand why, look at the taxes on the Brodie Building, and what will happen if or when it is razed to make way for condos.

The land is already assessed at $10 million. This is considered to be “its best and highest use” — i.e., as if it were the site of a condo tower, not just a handful of modest businesses. Of course, the value of a new 100-unit condo tower would be about $39 million, or 400 times more than the $90,000 building that is there today.

Yet the city’s tax take from the redeveloped property would drop by about $22,000

How can this be? After all, the value of the new building plus the land adds up to nearly $50 million, or five times more than the land and the old building.

Well, the existing site is taxed at the business rate, which is six times higher than the residential rate. If you do the math, a six times higher rate on a $10 million property produces a tax bill of $152,000, while the residential rate applied to 100 units with a combined value of $49 million works out to just $130,000.

But the $22,000 loss of tax revenue is just a small part of how redeveloping the site would hit the city budget. The big impact is on the cost side of the ledger:

A formula that estimates how much demand various properties place on the city deems that the current occupants of the Brodie Building consume $72,000 worth of city services, while the occupants of 100 condos would consume $235,000 worth. Thus, Sullivan calculates, city revenue will drop by $22,000 — or 14.8 per cent of what it gets from the existing property — and its costs will rise by $213,000, or 227 per cent.

Higher and higher taxes

What happens when the city takes this kind of budgetary hit?

Well, it never seems to tighten its belt. It just ratchets up its tax bills.

The way it makes up the shortfall goes a long way to explain how Vancouver’s property tax system got to badly skewed.

Prior to 1983, back in the day when the B.C. government set property tax rates, the business rate in Vancouver was roughly 21/2 times the residential rate.

That was more or less what it should be. People calculate “fair” rates in various ways, but most agree that businesses should pay somewhat more, for several reasons. For one, municipal taxes give them a deduction for federal and provincial tax purposes, which means each $4 they pay actually costs them only $3. Also, consumption studies show they put more strain on city services per dollar of assessed value.

So if the city were to increase the tax load on business properties at a ratio of 2.5 to 1, commercial property owners wouldn’t have much to whine about. And that’s just what council did in 1984, the first year it got to set its own tax rates.

At the same time, council adopted a formula, which has changed only slightly, to divide the total tax bill 60-40 between businesses and residents.

What has happened since is that home-building has dramatically out-stripped business growth. This means that existing residents get lots of help from newcomers — these days about 6,000 a year — to pay their percentage of the total tax load. But there aren’t many new companies to help pay the extra tax load added to the business portion.

In token recognition of this, the city has tinkered with the percentages. The split is now down to 55 per cent paid by business, and 45 by residents. But this does not compensate for the imbalanced growth in a city where residential property values have soared seven-fold over 20 years, while the value of commercial properties has merely tripled.

Today, 83.2 per cent of the assessed value of all property in the city is residential, yet businesses still pay 55 per cent of the property taxes. To generate this much revenue, the general business tax rate has to be set six times higher than residential rates, and the rate for other categories higher still. Utilities pay 12 times more than residents, and the city’s 30 remaining major industries pay 10.2 times more.

The current council is the third in a row to commit itself to shifting one per cent of the total tax burden from businesses to residents each year. But there are three problems with this:

First, despite the promise, they don’t do it every year.

And even when they do, the impact is minimal. Gallery owner Geisheimer wryly notes that last year, when council lived up to its promise and made the shift for the first time in three years, her tax bill still went up $7,000.

And finally, Sullivan makes the case that the city is shooting at the wrong target. A 1996 study by KPMG found that businesses paid $2.07 for every $1 of city services they consumed, while residents paid just 57 cents. That means business paid 3.7 times more for services than residents paid.

KPMG assumed — a bit arbitrarily, I think — that a 3-to-1 ratio would be fair. To get there, it proposed the one-per-cent-a-year shift in tax burden that was adopted by subsequent councils and has been acted on sporadically.

Data published by the city shows slow movement toward the goal of a 3-to-1 ratio, until it finally was reached last year. The trouble is, Sullivan says, the assumption on which the data is based turns out to be far too low.

In 1996 when KPMG did its study, residents were consuming 71 per cent of city services and businesses 29 per cent. Today, after a decade of sharply imbalanced growth, there are more residents and fewer businesses. The result is that residents now consume 76 per cent of services and businesses just 24 per cent.

So, do the math and you find that businesses are now paying 4.7 times more than residents for the services they use. That’s a 27-per-cent heavier load than in 1996, when council acknowledged the system was unfair.

Makes taxes realistic

What should be done now?

Two measures are needed:

The first is to tie the tax split — the portion paid by businesses versus the portion paid by residents — to actual consumption.

The Fair Tax Coalition proposes that an outside party be hired to do consumption studies every two or three years, and that city tax bills be based on the findings. Thus, as the mix of residents and businesses continues to change, so would the tax split.

Businesses would still, no doubt, pay a much bigger share of the bill than their actual consumption would dictate. But the proportionate load carried by each business would remain constant, probably near the ratio of three-to-one proposed by KPMG a decade ago, and it would not creep upward to the unsustainable level it has reached today.

While this would ensure a fairer burden for the business community as a whole, it wouldn’t protect businesses like the Art Works Gallery from the vicious swings that happen when their location is coveted as prime residential land.

Basing each business’s taxes on the rent it pays, not on land value, would correct that. This would not mean that businesses, as a whole, would pay either more or less total tax. It would simply even the load so similar businesses would pay similar amounts, and it would protect against sudden wild swings. Yet it would also keep market forces in play and allow neighbourhood business districts to evolve organically. Upscale neighbourhoods would inevitably command higher rents, and thus the more desirable business locations would continue to pay more — as they should.

The province has already agreed to enact legislation this spring to base taxes for port-based businesses on their rent. It would be easy to extend the practice to all of Vancouver, and possibly to other cities if they face the same kinds of inequities.

Given the way lawyers and politicians work, however, this will take time. So city council should take two interim steps without delay:

First, it should get its spending under control. In inflation-adjusted dollars, the city’s tax take has shot up 57 per cent in the last 10 years. Even adjusted for population growth, the per-person tax take is up 21 per cent.

Council should cap this year’s business tax increases and keep it capped until a long-term, equitable solution is in place.

The council of the day approved such a tax cap back in the early 1990s, when it recognized the alternative was to see many firms die. The dismal vacancy figures in Yaletown today, the fact that the city has fewer businesses this year than last, and the urgent concerns voiced by business owners in every neighbourhood proclaim loud and clear that this grim prospect is at least as real today.

© The Vancouver Sun 2007