They’ll likely keep climbing until at least 2011: report

Derrick Penner

Sun

The mortgage insurer Genworth Financial Canada, using data from the Conference Board of Canada, reports that demand in Vancouver’s condominium resale markets will slow, but so will the rate of new construction. Photograph by : Vancouver Sun Illustration

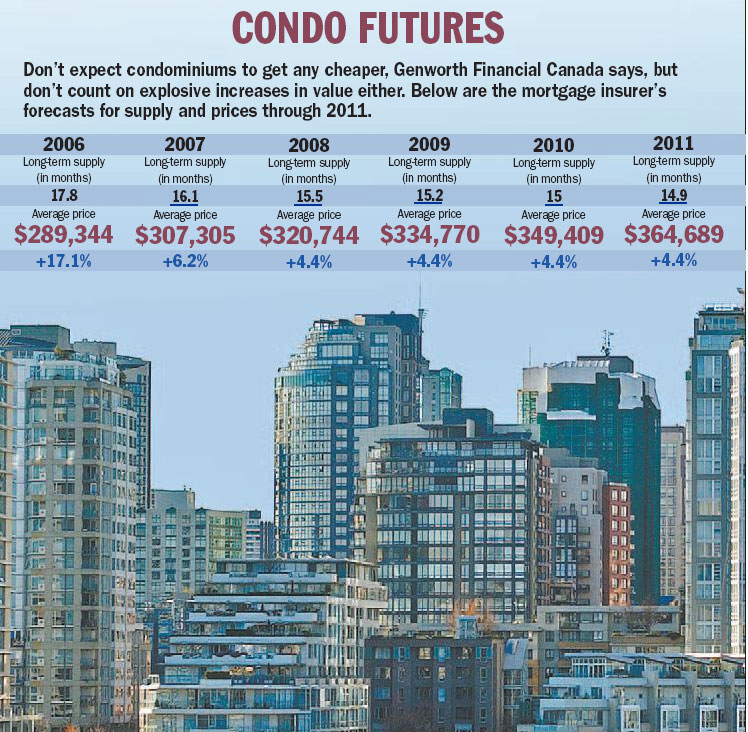

It’s good news if you own real estate, but bad news if you don’t: A new report predicts condominium prices in Greater Vancouver will keep rising through to 2011.

The mortgage insurer Genworth Financial Canada, using data from the Conference Board of Canada, reports that demand in Vancouver’s condominium resale markets will slow, but so will the rate of new construction.

The result will be enough demand to push prices up 6.2 per cent to an average $307,305 this year, then 4.4 per cent on average through the end of the decade.

That will make the average condominium price in Greater Vancouver $349,409 by 2010, compared with $289,344 in 2006.

“Vancouver’s condominium market took off in 2001 and has not looked back,” the report says, and supply has not kept up with demand.

And although sales of existing condominium units fell 10 per cent over the first three quarters of 2006, the report said supplies were still tight and will remain relatively so through 2011.

Price gains up to 2006, the report adds “have been so steep that affordability is becoming an issue,” even for relatively less-expensive condominiums.

However, Genworth Financial president Peter Vukanovich said he hopes the report reassures people that the bottom is not about to fall out of Vancouver’s condominium market.

“People are seeing a lot more skyscrapers and cranes [around Vancouver] and are wondering ‘who is buying all these things, and [saying] it can’t last,'” Vukanovich said.

“When you do the research, you see we have some well-balanced supply being met by demand.”

Vukanovich said Genworth has just started working with the Conference Board of Canada to generate semi-annual reports on Canadian housing markets.

He added that in research being done on rental markets, they found more people are renting because they think prices will go down.

“Our job is to help people get into homes the cheapest possible way through mortgage insurance,” Vukanovich.

He said potential buyers might be less reticent if they had more confidence that prices are going up.

“I’m not trying to stimulate demand, I’m trying to put people more at ease,” Vukanovich said.

Robyn Adamache, senior market analyst for Canada Mortgage and Housing Corp., said the findings of the Genworth and Conference Board research are consistent with her expectations for the market to trend down gradually.

“We see that, both in terms of housing starts and in terms of resale markets, things plateauing now,” Adamache said. “We are still expecting a soft landing, and that’s what’s happening.”

One unknown, however, is how many owners of condominium units that are still under construction plan to sell them upon completion, said Tsur Somerville, director of the centre for urban economics and real estate at the Sauder School of Business at the University of B.C.

“The piece we don’t understand is how many completed units are coming back on the market because they’re investment units,” Somerville said.

Somerville added that the Genworth report appears to assume that the absorption of new units will continue to increase.

However, if anything weakens the local economy “as we start having less of a construction-project employment boom,” demand in the condo resale market will also decline.

The metropolitan condominium outlook reviewed resale markets in Vancouver, Calgary, Edmonton, Toronto, Ottawa and Montreal and is based on data from the Conference Board of Canada, Canada Mortgage and Housing Corp. and the Canadian Real Estate Association.

© The Vancouver Sun 2007