Hong Kong recently increased their stamp duty on foreign buyers from 15% to 30%

Juwai

other

This not only means it’s now more expensive for non-residents to buy property in the city, but also means that Chinese buyers – who long have considered Hong Kong a notable playground for them – will now be casting their eyes elsewhere in search of better deals.

After all, Chinese demand for property remains robust, and with the recent property cooling measures implemented nationwide in China, the prospects for Chinese real estate investments in global markets is stronger than ever.

Buoyed by other fundamental factors, such as the RMB’s depreciation – 6% against the USD during the past 12 months2 – as well as mainland buyers’ surging familiarity and soaring interest in outbound travel and lifestyles abroad, the Chinese are set to become an even more lucrative market for international agents and developers in 2017.

Hong Kong government moves to cool red-hot property market

Hong Kong real estate – already considered one of the least affordable housing markets in the world – has seen its prices continue rising throughout the year, especially in recent months.

To counter this, Hong Kong’s government recently swung into action by adjusting the rate of real estate stamp duty for non first-time buyers – both individuals and companies – to 15% of the property value.1

Foreign buyers, who are already charged with an existing 15% stamp duty rate, must now pay an extra 15% – making it a 30% stamp duty fee on the price of a property.3

And although the government have also pushed the largest supply of new housing in H1 2016 in a bid to dampen price growth and provide more affordable housing4, prices have not behaved in line with the government’s hopes.

Mainland buyers slated to move on from Hong Kong

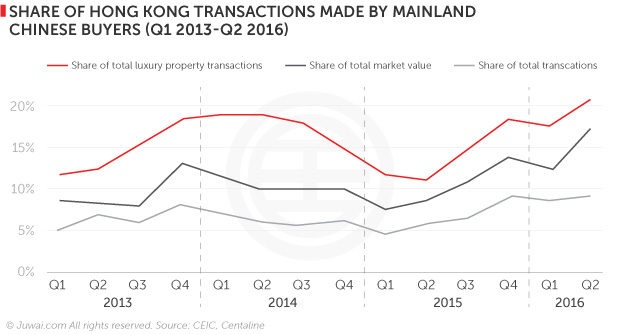

It’s vital to note that one of the biggest contributing factors to Hong Kong’s surging real estate prices comes from increasing demand from China-based buyers – many who sought to escape purchase restrictions imposed onto China’s domestic market, and to shield their assets from the RMB’s recent devaluation.

What drove mainland Chinese buyers to Hong Kong? Two reasons: the RMB’s depreciation, and the fact that investor options in China have narrowed and price growth prospects weakened after the Chinese government increased sales taxes, tightened mortgage criteria, and cracked down on multiple home purchases to cool price growth in mainland cities.10

Now, with this new 30% stamp duty taxed on foreign buyers though, Hong Kong properties will no longer be as attractive as before to mainland property investors. Yet these two same factors, fuelled by the Chinese incessant hunger for property ownership, remain the same, and thus, this will continue to push Chinese property investors to seek for other opportunities out of China and Hong Kong in the near future.

So where would this surge in demand from Chinese buyers for overseas properties go next?

4 upcoming Chinese investment hotspots to eye

While it’s still early days yet, we’ve seen these hotspots receiving much attention from Chinese buyers lately, and we believe this 30% foreign buyer tax in Hong Kong may further boost Chinese property investor interest there in the following months.

United Kingdom (UK)

Chinese buyer enquiries for British properties rose 30% to 40% on Juwai.com approximately four weeks after the Brexit referendum, with a record number of enquiries from Chinese buyers charted on Juwai.com in September.11 With the sterling still weak and at a 30-year low11 amidst the continued uncertainty on whether Brexit would happen, Chinese property hunters have been quick to strike while the iron’s hot (especially in London), and we foresee this trend will continue onwards into the new year.

South Korea

Chinese buyers are moving inland away from Jeju Island to Seoul12 – property sales in Seoul to Chinese investors have tripled so far in 2016.13 With China being just a few hours away from South Korea (Beijing is just a three-hour flight away from Seoul), combined with the seemingly undying Chinese love for all things Korean – celebrities, music, drama, cosmetics, fashion, cuisine, to name just a few – we expect Chinese buyer presence in South Korea to continue growing down the road.

United States (US)

Chinese buyers maintained their position as the dominant buying force in the US, accounting for some $27.3 billion worth of residential property sales, according to the latest figures by the National Association of Realtors (NAR).14 Will Chinese property investment increase now that Donald Trump is officially set to become the next US President? We’ll be keeping an eye on the US, that’s for sure.

Malaysia

Chinese buyer enquiries for Malaysian properties on Juwai.com soared 550% in the year to August 2016.15 Furthermore, with the news that Alibaba tycoon Jack Ma has been appointed as the digital economy advisor for the Malaysian government16 following Malaysian Prime Minister Najib Razak’s third official visit to China just a week ago17, this could send some additional Chinese attention over towards Malaysia.

Chinese market to become even more lucrative market in 2017

The Bank of America Merrill Lynch has forecasted a decline of 5% – 10% in sales and a softening in prices for China’s real estate market.18

This, combined with the CLSA’s prediction of a further 18% devaluation of the RMB – RMB 8 to the USD – means the Chinese property market is expected to cool further in 2017.19

What this really means, though, for international agents and developers, is that prospects are strong for increased demand for overseas properties emerging from China over the next 12–18 months.

In short, what has been a lucrative China market – worth some $93 billion in residential sales in the US between 2010 and 201520 – is poised to look even more attractive than before.

So, be sure to ramp up your marketing activities to target Chinese buyers in the coming months, especially as Chinese New Year – China’s first golden week of 2017 and a major sales season for real estate agents selling to Chinese buyers – is fast approaching, and will kick off on 28 January 2017.

2016 © Juwai.