RUDY NIELSEN

Other

A good friend recently asked: “When will British Columbia’s recreational market recover?”

I checked the numbers (and my gut) and, in my opinion, the wording is wrong. The market hasn’t crashed, there’s nothing to “recover.” Like all healthy markets it has simply changed and, like all healthy markets, it is best get aboard while you can and before the next round of “upside” kicks in, the next round of appreciation.

In one aspect the market has shrunk; sales volume is way off its 2006-07 peak. But in other ways it has evolved, becoming exclusive, maturing, consolidating. And there’s no big reason for values to fall.

I define “recreational” as vacant rural land: lots, acreages, fields, forests and waterfront, fresh and saltwater. Anything with even a steady, clean creek sells for a premium. I don’t count rural condos, resort chalets or cottages, just land.

Landcor Data numbers

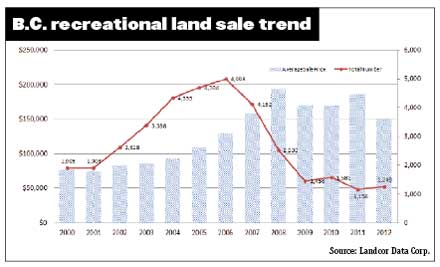

Prior to 2001 the market was flat: around 1,900 sales a year at about $75,000 per handshake. But, as the millennium turned, so did the market. Sales rapidly ramped up, peaking at nearly 5,000 sales annually just prior to the recession in 2008.

Supply and demand. Prices got excited and, as usual, inertia carried values past the volume peak. Average land sale prices topped out at around $200,000 in early 2008.

But sales volumes plunged. Currently sales are just over 1,200 a year, far below the peak and even below the activity of a decade earlier.

When volumes crashed prices dipped, but mostly held firm. The average recreational land price is now $150,000 on far fewer sales, which means fewer vendors. Just my guess, but those earlier owners are holding onto what they’ve got for cheap, and the resulting lower inventory keeps price reductions in check.

Because of the nature of recreational, the current ownership and the financially secure buyers it attracts, I can’t see prices reversing and/or volumes rising in the foreseeable future.

B.C. is envied for clean air, potable and abundant water and livable density. As the world becomes ever more congested, this envy will, in my opinion, turn into action from new local and a growing cohort of “foreign” buyers seeking personal recreational escapes and longer-term “legacy” investments, not from over the Rockies but overseas. Not immediately, but I see it coming.

Like all real estate markets recreational has its cycles. But, unlike those other markets, recreational land has a unique self-limiter – there’s only so much to go around. Land is steady, fixed and finite – and with B.C. recreational, it’s surprisingly scarce.

Scarce land

B.C. covers a whopping 233,449 million acres. Landcor Data sliced away Crown Land, First Nations, the Agricultural Land Reserve, residential, industrial, commercial and other build properties, and pulled the remaining and most recent “vacant land/rural” titles, registered addresses and total acreage. The figures are interesting.

Basically, ownership remains firm. Back in 2010 there were 89,256 titles. In 2011 it slipped to 88,542, dropped further to 87,921 (2012) and increased to 89,103 titles in the first quarter of this year.

Of these 89,103 titles, 87,025 or almost 98 per cent are registered to Canadian addresses: 80,060 in B.C.; 5,678 in Alberta; 713 in Ontario; and 574 scattered in other provinces. The foreign contingent: 1,551 U.S.; 159 Germany; and 103 U.K., with 265 other titles sprinkled around the globe. China and Kenya owners guard the rear at one title apiece.

Although the title count is firm, total acreage size of the transactions grew from 4.371 million acres (2010) to 4.367 million (2011) to 4.384 million (2012) and, in the first quarter of this year, 4.453 million acres – still a mere 1.91 per cent of the entire province.

As a finite desirable asset, I believe B.C. recreational land is on a comparatively slow – but fundamentally solid – series of appreciation cycles. The numbers might dip here and there, but the upward price trend is on firm ground, literally and figuratively.

Meanwhile, get it while you can.

Rudy Nielsen is president and founder of real estate analyst firm Landcor Data Corp. and NIHO Land & Cattle Co., one of the largest owners and developers of recreational land in B.C. For more than 40 years, Nielsen has been involved in the B.C. real estate industry as a developer, appraiser, entrepreneur, adviser and dealmaker; in one 10-year period alone, he sought and successfully closed more than 1,000 deals. Nielsen may be contacted through the Landcor Data website at www.landcor.com.

from Western Investor May 2013