Interest rates jump, mortgage rates to follow?

Other

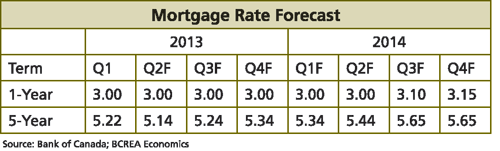

The Canadian five-year posted mortgage rate once again fell back to its historical low of 5.14 per cent in the second quarter, its lowest level since early 2012. The decline in fixed mortgage rates followed an equally historic dive in five-year Canadian bond yields, which reached an all-time low of 1.15 per cent in May. Indeed, rates across the long-end of the Canadian yield curve swooned in the second quarter but have since spiked sharply back to where they were to start the year.

Historically low funding costs for Canadian banks translated to deep discounting of mortgage rates for homebuyers with most lenders offering 5-year fixed mortgages equal to the prime rate of just 3 per cent. In fact, and in spite of attempts by some policymakers at discouraging lower rates, some lenders continue to advertise fixed-rate mortgages at well below prime.

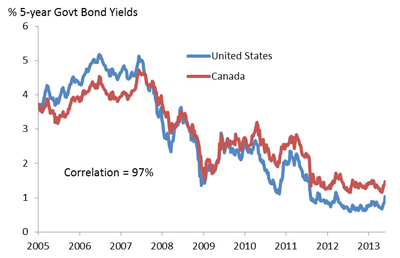

However, depending on the sustainability of the recent rise in interest rates, those discounts may become scarce. It is difficult to cite a definite cause for the recent rise in interest rates, and much of the rise in Canadian interest rates may have more to do with what is going on in the United States than in the domestic economy.

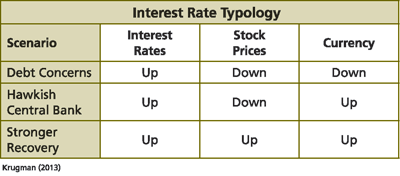

Generally, rising medium and long-term interest rates result from one of three scenarios. Markets may be concerned about government debt burdens and therefore demand higher interest rates.

In addition, comments by central bankers may drive the market to perceive a more hawkish stance for monetary policy, which would push long rates higher. Finally, markets may be pricing in a more positive global economic outlook and therefore a return to a more normal shaped yield curve. Each of these scenarios implies a mix of different behaviours in asset markets as shown in the table.

There are other factors at work, but given recent trends in equity, bond and currency markets in the United States, the recent rise in interest rates is likely being driven by expectations of a stronger US economic recovery. Regardless of the root cause of higher rates, given where yields currently stand, we anticipate a modest increase in the 5-year fixed-rate back to 5.24 per cent with the possibility of a further move up to 5.44 per cent if five-year yields continue to rise. As for one-year fixed rates, we expect very little, if any, movement over the next year and a half.