PETER MITHAM

Other

A rising tide lifts all boats and, for waterfront properties in B.C., that’s good news.

A recovery of residential real estate markets across the province and the emergence of more patient buyers and sellers are underpinning an upswing in recreational property activity.

“I’m seeing a lot more activity in the past two months than I saw at any period last year or in the past 18 months,” said Mark Lester, who oversees the specialized assets group at Sotheby’s International Realty Canada in Vancouver.

Waterfront properties on the coast are seeing a greater number of inquiries, offers and purchases; in the Okanagan Valley it’s a similar story, and even developers are beginning to approach planners regarding new projects.

But if the turnaround is a significant change from a year ago, Lester doesn’t harbour hopes of a return to the heady days of the mid-2000s. It was an ebullient era, with more ambition than caution and prices that haven’t been matched since.

The pace of activity in the Kootenays remains slow, while prices on the Gulf Islands, Vancouver Island and elsewhere are – by Lester’s estimate – down by between 20 per cent and 30 per cent

“They’re still not where they were six years ago,” Lester said. “When you fall off a cliff, it takes a long time to climb back up.”

Some properties have fallen harder than others.

Lester and partner Alan Johnson still have the listing for the 360-acre property in Ucluelet where Marine Drive Properties Ltd. planned to develop the ambitious Wyndansea Oceanfront Golf Resort. Debts overtook the project, however, and the oceanfront property was listed for sale in 2008 at $35 million.

Today the same site is available for just short of $10 million.

Discount prices

On the other side of Vancouver Island, north of Qualicum Beach, the final six homes at Qualicum Landing are being offered at “unprecedented pricing,” some at less than assessed value, with the real discounts seen in the top-end luxury models.

Originally launched in 2009, the project has a total of 62 units. Sales ticked up last year as pricing aligned with an upswing in buyer demand. This year the aim is to move the properties, with a starting price of $399,000 for a 1,065-square-foot cottage.

The patience of owners with the base price for properties is indicative of both the patience and the strength returning to the market.

Those handling recreational property elsewhere in the province spoke about the need, in the wake of the recession, to give a clear signal to the market that prices had stopped falling by pricing properties at a level where they wouldn’t fall further. This would, theoretically, leave room for investors to reap rewards.

Now that strategy seems to be at play across the province, as buyers recognize that it’s safe to return to the market and make the purchases they’ve deferred for so long.

“This year, as far as recreational waterfront property is concerned, is better than we’ve seen since 2008,” said Joel O’Reilly of Royal LePage Sunshine Coast in Sechelt.

O’Reilly sold seven waterfront properties in March, a sharp contrast from the lacklustre activity of the past few years.

“Buyers are feeling more confidence in the marketplace, and also they’re tired of waiting,” he said. “Some of these buyers we’ve been working with for a year or two years. They’ve been watching and waiting.”

With prices for waterfront cottages down 20 per cent relative to 2005 and in a stable place for the past year, O’Reilly said buyers are ready to act.

“Buyers are seeing some good value, and that’s why they’re moving forward,” he said. “You are seeing some prices now that you would not have seen back then [2005].”

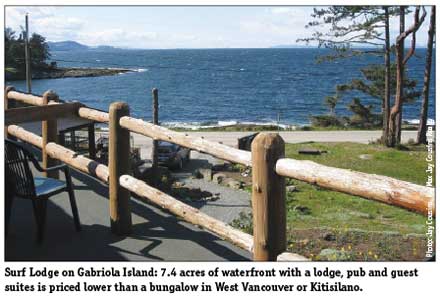

The waterfront deals extend to the commercial sector, according to Jay Cousins of Re/Max Jay Cousins Realty in Nanaimo, who notes that trophy Island resort properties have been deeply discounted and says that a baby boomer could sell a West Vancouver or Vancouver house and purchase a going recreational business opportunity with Gulf Island waterfront.

An example is the renovated Surf Lodge on Gabriola Island, with 7.4 acres of waterfront, a fully equipped lodge with guest rooms, a 50-seat pub and dining room, a three-bedroom home for the owner and a separate cottage, all on six separate parcels with a further five acres for future development. The property, which Cousins said would have fetched about $2.5 million at market peak, is listed now for $1.79 million, with a possibility of negotiation.

Even at the list price, though, it is still below the “benchmark” near-$2 million price of a detached house on the West Side of Vancouver or West Vancouver according to March figures from the Real Estate Board of Greater Vancouver.

Domestic demand

It is local demand, in fact, that is expected to buoy waterfront sales.

A decade ago, buyers from the U.S. were using favourable exchange rates to seek a safe haven in the wake of the terrorist attacks on New York and Washington, and the shadow of conflicts in Afghanistan and Iraq.

Now, it’s downsizers from the North Shore and the West Side realizing the great value waterfront properties a short ferry ride away can offer.

“They’re selling their non-view tear-down family home for $3 million, [and] what they can get up here is remarkable,” O’Reilly said. “It’s incredibly inexpensive here in comparison.”

He has listings for oceanfront properties five minutes from the ferry in Gibsons at $3 million, for example; the same properties in West Vancouver would command four times as much.

The attractive pricing makes waterfront properties in areas like the Sunshine Coast appealing to investors, too. With a mix of young families and vacationers seeking furnished getaways in a popular locale with few hotels, waterfront properties can command enough to cover monthly expenses.

There’s no shortage of demand for a comfortable waterfront cottage. Rents typically run at $2,500 a week for vacation rentals; less for monthly rentals.

Lester adds that the rental market has also received a boost in recent years from people who would like a cottage but haven’t felt confident about jumping in. This is something he expects more people to do this year.

But he believes buyers are returning to the notion that recreational properties, and real estate generally, is a long-term hold rather than a quick play.

A tighter financing market initially helped set the tone, with many of the major banks refusing to bankroll purchases in areas deemed to be marginal, and buyers are now accepting that appreciation won’t take care of their mistakes.

“You’re buying for the lifestyle, but you’ve got to look long term,” Lester said.

from Western Investor May 2013