Other

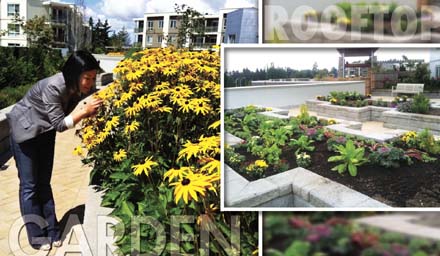

ROOFTOP COMMUNITY GARDEN: The first condo community garden in a private development B.C. has been set up at Morgan Crossing in South Surrey. The gardens cover nearly an acre of rooftop and outdoor space for residents who want to share garden duties and grow their own food. Photo: Larco Developments

The resiliency of Canada’s housing market represents a positive surprise among 2011’s negative economy surprises, according to Douglas Porter, deputy chief economist, BMO Financial Group. Porter was commenting on the Canadian existing home sales numbers, which rose 12.3 per cent from year-ago levels in July and held steady from the prior month. “Canadian housing remains surprisingly robust, thanks to still-low interest rates and solid job growth,” said Porter. “While the strong year-over-year growth is flattered by a weak year-ago comparison – when the HST was introduced in B.C. and Ontario – sales are certainly faring better than what we expected earlier this year. (Last month, British Columbians voted to end the HST, which is to be removed by March of 2013.) While new listings have also risen recently, the backlog of unsold homes just nudged up last month, almost bang on the long-run average. “The recent financial market turmoil may temporarily weigh on activity, but sales should ultimately find support from continued exceptionally low borrowing costs.” “Canada’s [residential] real estate market has great resiliency,” said Laura Parsons, mortgage specialist, Bank of Montreal. “As long as consumers continue to push demand, which remains the case, we see ongoing strength in the housing market across the country.” Parsons counseled home buyers to consider a shorter amortization period in order to become mortgage free faster. She also noted that stress testing a family’s budget using a mortgage payment based on a higher rate can help avoid nasty surprises in the future should interest rates rise. CREA more bullish in outlook The Canadian Real Estate Association (CREA) has revised its forecast for home sales activity via the Multiple Listing Service Systems of Canadian real estate Boards and Associations for 2011 and 2012. Overall, sales activity and prices remained stronger than expected in the second quarter. Sales momentum was also better than expected heading into the third quarter. As a result, the 2011 national forecasts for sales activity and average price have been raised slightly. National sales activity is forecast to reach 450,800 units in 2011, up less than one per cent from levels in 2010. CREA had previously forecast a decline of about one per cent for activity in 2011. British Columbia’s 2011 sales forecast has also been revised slightly higher, in recognition that home sales there appear to have bottomed out sooner than previously anticipated. Copyright Real Estate Weekly.