Other

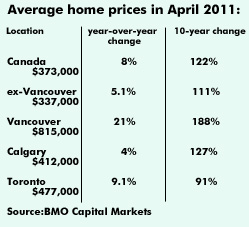

Vancouver’s housing market is poised for a correction, with prices triple what they were a decade ago and the average home now running 11.2 times family income, says a report Tuesday from BMO Capital Markets. That ratio is more than double the level of a decade ago and implies a market that is “priced for perfection,” said BMO senior economist Sal Guatieri. “Four corrections in the past three decades saw declines averaging 21 per cent,”Guatieri cautioned in the report. “However, if interest rates stay low and wealthy immigrants continue to pour into the city, prices could stabilize sooner than in past downturns.” Nationally, he said, average existing house prices have more than doubled in the past 10 years, hitting new highs in April. “Prices are 5.1 times median family income and housing costs an extra two years of gross income compared to 2001, when the boom began and valuations were closer to historic norms.” Affordability still remains intact, with first-time buyers allocating about one-third of their disposable income to mortgage costs, but even a slight rise in rates could cool the national market, as could a slowdown in job growth, he added. The report examines how national housing prices mask differences in valuations in three of Canada’s four largest cities — Vancouver, Calgary and Toronto. It found that prices have also doubled in Toronto over the past decade and now sit at 6.7 times family income, compared with 4.3 times in 2001, a level reached in the late 1980s which led to a 25 per cent reduction in prices. Mortgage rates were then near 14 per cent compared with today’s sub-four-per-cent rates. However, while today’s valuations may be sustainable thanks to those low rates, they could be hurt in a more normal rate environment, he adds. “Given our outlook for a moderate increase in rates in the next two years, prices could soften or at least stabilize for a while. A possible overhang of condos could aggravate the weakness.” Calgary, on the other hand, is one of the few Canadian cities that have yet to return to pre-recession peaks. Average prices are at 4.2 times income, and barring a pullback in energy prices, “stand a reasonable chance of growing alongside incomes in coming years,”Guatieri said.