Other

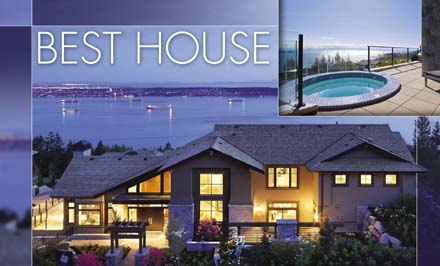

BEST HOUSE: This custom house (over 3,500 square feet) in West Vancouver captured the Award of Excellence from the Urban Development Institute for British Pacific Properties. Photo: UDI

TD Bank CEO Ed Clark, told a recent mortgage conference that the government should cut the maximum mortgage amortization from 35 years to 25 years. “We see a world in which low interest rates and excess liquidity has created asset bubbles all over the world,” Clark told reporters. Clark says Canadians have been following a policy of: “‘Don’t save. Take a longer period to spread out your payments.'” “I don’t think that’s good public policy,” Clark said. The idea of reducing amortizations has been floated before, most recently this year when it was speculated that the Finance Department might cut the maximum amortization to 25 years. The government last changed amortizations two years ago. At that time, they were cut back from 40-years to 35-years on high-ratio mortgages. However studies show that, in almost all cases, people who take 35-year amortizations plan to pay off their mortgage much quicker. In fact, the average Canadian gets rid of their mortgage in 1/2 to 2/3 of their original amortization, according to insurer sources. In other words, due to pre-payments, people pay off their 35-year mortgages in far less than 35 years.

More buyers can afford homes

RBC Economics Research has released a report saying the proportion of pre-tax household income it takes to own a home declined in the third quarter of 2010 after a full year of deteriorating home-ownership affordability. Lower home prices and mortgage rates were the reasons for the recent improvement. “The improvement in affordability during the third quarter has relieved some of the stress that had been mounting in Canada’s housing market over the past year,” said Robert Hogue, senior economist for RBC. “After appreciating rapidly during the strong rebound in resale activity last year and early this year, national home prices recently came off the burner and retreated modestly as market conditions cooled considerably through the spring and summer.” RBC said it took 40.4% of household income, on average across the country, to own a bungalow between July and September. That was 2.4 percentage points lower than the second quarter. The cost for owning a standard two-storey home fell 2.5 points to 46.3% on income, and the affordability rate for condominiums was down 1.4 points to 27.8%. Looking at the percentage of household income needed to own bungalows in major markets across the country, it was 68.8% in Vancouver, 47.2% in Toronto, 41.7% in Montreal, 38.2% in Ottawa, 37.1% in Calgary and 32.7% in Edmonton.

Copyright Real Estate Weekly