Their partner may end up owning 50% of it

Garry Marr

Sun

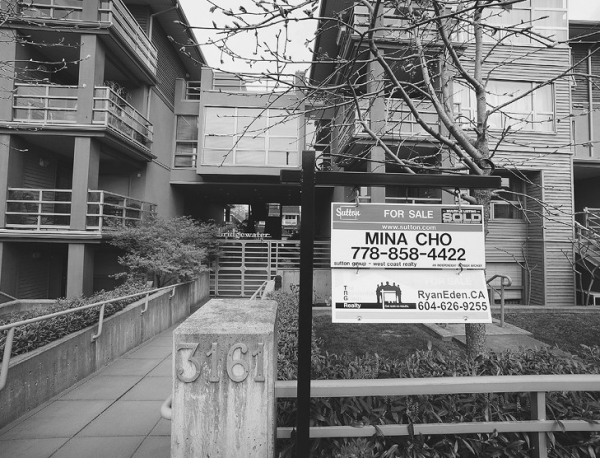

More Canadians are considering buying condos for their children. There are options to avoid financial problems. Photograph by: BIll KEAy, CAnwEsT NEws SERVICE, Financial Post

It’s one thing to buy your son or daughter a condominium, it’s quite another to have their partner or spouse end up owning half of it.

A column earlier this month about a new TD Canada Trust survey that found 10% of Canadians are considering buying a condominium for their adult children, up from 5% a year ago, drew plenty of reaction from readers.

On one side were the people who justified the expense because the cost of housing has risen so dramatically over the last decade. On the other side were people who maintain children should have to build their own wealth.

The most compelling argument may be the one made by a 55-year-old retired certified general account in Vancouver who emailed me with a story about a former client who almost gave away a significant amount of money.

“I had a client in the office who had just retired and sold his home and moved into a townhouse. He said to me, ‘my kid is getting married and I’m going to give them money for a hefty down payment on their first home,’ ” recalled David Morrow about the 1995 conversation. “I said, ‘you should take back a second mortgage’ [as opposed to giving his son a gift].”

The client was worried about what his child and future daughter-in-law would think of him if he demanded they sign a second mortgage that would be placed on the property after the first mortgage from the bank. The accountant didn’t know it at the time, but the client decided to go the loan route.

“The next time I talked to him he says to me, ‘that was the best advice you ever gave me. My son and his wife split up,’ ” Mr. Morrow wrote.

Certified financial planner Ted Rechtshaffen said the divorce issue frequently comes up when talk turns to buying children property and it’s not something that should be ignored.

However, there is significant advantages to children holding property in their own name. The most obvious reason is there is no capital gains tax on the principal residence. If you own your kid’s house, you owe tax on any gains.

“There is zero tax on gift giving in Canada,” said Mr. Rechtshaffen. “If you are going to leave money anyway, you can avoid probate [fees] by giving them the money [while you are alive].”

He thinks giving your children a loan may be preferable to providing an outright gift or staying on the title of the property. He would not go so far as to register a mortgage on the property.

“It may be a loan that you end up forgiving,” said the financial planner. “It doesn’t need to be listed anywhere. It could be a note just being held in a safety deposit box. It could be forgiven with a note in your will.”

Michael Polzler, executive vice-president of Re/Max Ontario-Atlantic Canada, says the potential pitfalls hasn’t stopped parents from giving gifts of downpayments.

“Everybody wins. The kids get money for their starter home and the parents get the kid out of the house,” says Mr. Polzler. “If the marriage breaks down, it’s just part of the risk. If you’re the parent, it’s a lot better than having your kid in the basement.”

© Copyright (c) The Vancouver Sun