Tax threshold is below average price of new home in many areas

DERRICK PENNER

Sun

REUTERS FILES

The provincial government is throwing the homeconstruction sector a Harmonized Sales Tax break, raising the threshold for its maximum tax rebate and extending the deadline for when the HST will apply to new housing.

The provincial government announced on Thursday that the threshold for which the maximum HST rebate will apply will be raised to $525,000 from $400,000, and the harmonized tax will not be levied against pre-sale homes for which the buyer signed a purchase contract prior to Nov. 18.

Previously, the tax was to apply to new homes for which buyers took possession after July 1, 2010.

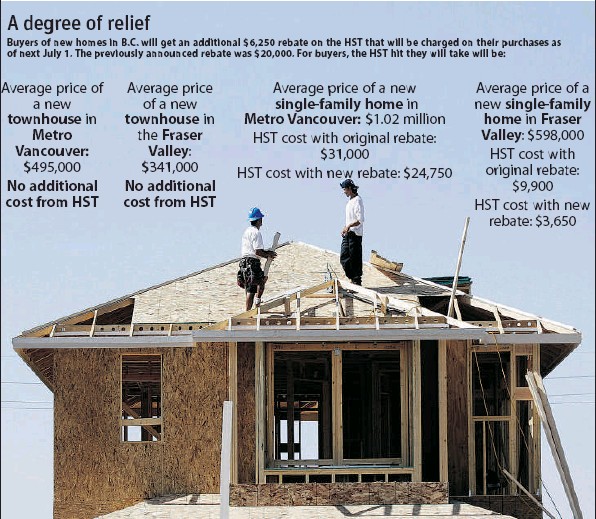

The announcement effectively neutralizes the HST on homes priced under $525,000, and increases the maximum rebate offered to homebuyers purchasing houses over the threshold to $26,250 — up from $20,000 under the old threshold.

In making the announcement, Finance Minister Colin Hansen said “ we heard the concerns from consumers and industry.”

“This increase will move the threshold to above the average new-home price in the province,” he added. It will be the highest such rebate in Canada .

However, the threshold is well below the average price of a new home in many communities around the Lower Mainland, which left many calling the rebate shift only a “ good first step.”

The average price of a new detached house in Metro Vancouver in 2009 is about $1.02 million, according to the calculation of Jennifer Podmore Russell, senior manager in the financialadvisory practice at the consultants Deloitte. In the Fraser Valley, the average new house is $598,000.

She added that the price of a new condominium in some communities is also above the new threshold, such as in the east side of Vancouver where the average price is now $557,000.

An average new townhouse on the west side of Vancouver is $763,000.

Peter Simpson, CEO of the Greater Vancouver Home Builders’ Association, said the industry lobbied government to raise the threshold to $600,000, but appreciates that the government offered some leeway on the HST.

“We’ve got to give credit where credit is due,” Simpson said in a telephone interview from an industry conference in Halifax.

“ This is something where [government] was firmly entrenched and, at one point, weren’t going to move on at all.”

Raising the threshold to $525,000 was “a substantial step,” but he argued that “there are a lot more steps [to take] in this tax-mitigation journey.”

Neil Chrystal, president of the Urban Development Institute’s Pacific chapter, said the industry appreciates the raising of the threshold as it “makes a lot of sense and is the right thing to do.”

However, Chrystal said a lot of his members are disappointed that the grandfathering clause did not give developers more of a window to sell their current inventory HST-free.

Chrystal added that the industry is still hopeful that government will consider exempting new home sales from the provincial property-transfer tax as a measure that wouldn’t affect its implementation of the HST, but would mitigate its affect on higher-priced homes.