Bump up to $525,000 HST threshold on new homes not enough, association says

Ian Austin and Suzanne Fournier

Province

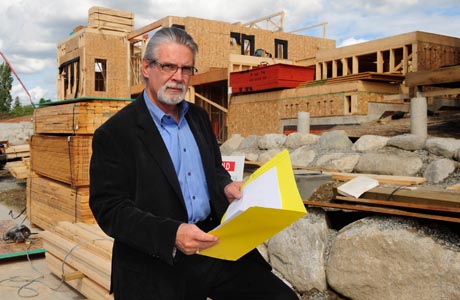

‘We’re willing to shake their hand for coming this far, but we’re not giving any high fives,’ says Greater Vancouver Building Association chief executive officer Peter Simpson, who will continue to lobby for more concessions. Photograph by: Nick Procaylo file, The Province

The B.C. government added a new wrinkle to its HST sales pitch Thursday, hoping to bring the construction industry onside by promising to raise the threshold for the new-home-added tax from $400,000 to $525,000.

The 12-per-cent harmonized sales tax is set to kick in July 1, 2010, and B.C.’s recession-hit construction industry wanted homebuyers paying up to $600,000 not to have to pay more tax as homebuilders strive to stay afloat during a nasty business cycle.

“We’re willing to shake their hand for coming this far, but we’re not giving any high fives,” said Greater Vancouver Home Builders Association chief executive officer Peter Simpson, who will continue to lobby for more concessions.

Simpson said the $400,000 threshold was completely unrealistic: “Where could you buy a single-detached home anywhere in the Lower Mainland for that price? Even this new threshold will primarily help out the builders in Cloverdale and Abbotsford, and other suburbs.”

Finance Minister Colin Hansen — who has been on the defensive since the B.C. government flip-flopped on an earlier pledge not to bring in the HST — said he had listened to consumers and builders in bumping up the threshold.

“We heard the concerns from consumers and industry about how the HST might affect homebuyers, and this increase will move the threshold to above the average new-home price in the province,” said Hansen.

“At $26,250, this provides the highest maximum provincial rebate in Canada.

“A similar rebate will also support the construction or substantial renovation of affordable rental housing.”

The B.C. government will get a $1.6-billion gift from the federal government in exchange for adopting the federal-provincial harmonized sales tax.

But NDP finance critic Bruce Ralston said the move will do little to win over British Columbians who hate the HST.

“I think this is putting lipstick on a pig,” said Ralston. “They don’t want the homebuilders out there hammering away at them.

“Our position is clear — we’re opposed to it right across the board. We think it’s a rotten tax.”

The HST is set to go into effect July 1 in both B.C. and Ontario, where the new harmonized tax is also proving to be a hard sell.

In its attempt to sell the HST to a skeptical public, the Ontario government recently announced that the HST would no longer be applied to newspapers or meals under $4.

© Copyright (c) The Province