Fiona Anderson

Sun

Low mortgage rates continue to entice first-time buyers into the real estate market, pushing up prices in the Lower Mainland and keeping sales hot.

Home sales in the Vancouver area continued upward in September, with 3,559 sales through the Multiple Listing Service, up 3.4 per cent from the 3,441 sales in August, according to numbers released Friday by the Real Estate Board of Greater Vancouver (REBGV).

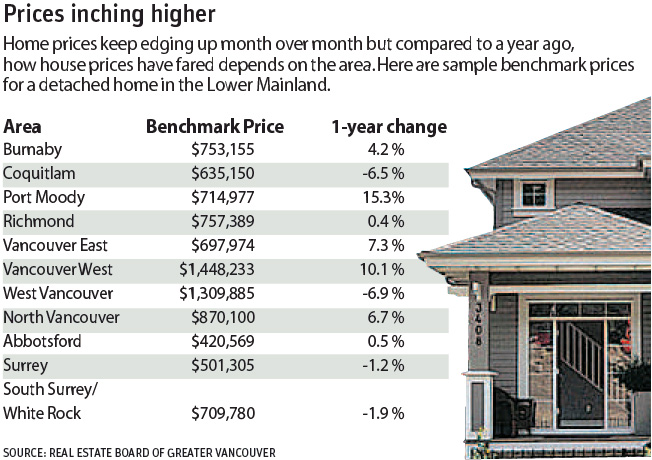

Prices have followed suit, and benchmark prices — the average price of a typical home in a particular market, such as detached or condominium — were 1.6 per cent higher in September than they were a year earlier, regaining much, but not all of the losses suffered since the peaks reached in the summer of 2008.

Interest rates are still playing a large role, attracting first-time buyers, said Scott Russell, president of the REBGV.

Rates on mortgages hit all-time lows in May, but while they have inched back up they still remain incredibly low.

For example, Coast Capital Savings had a rate of 3.79 per cent on a five-year fixed mortgage in May. Now they are offering a special rate until November of 3.85, the credit union’s vice-president of retail services, Sheena Hanbury said in an interview. And they have seen the number of new mortgages for more than $100,000 triple in the most recent quarter, compared to the first three months of the year.

Last week, BMO Bank of Montreal lowered one of its rates. The bank’s five-year variable mortgage rate is now prime, currently 2.25 per cent, down from prime plus 0.3 or 2.55 per cent.

Those rates make prices affordable, which is luring first-time buyers, said Paul Penner, president of the Fraser Valley Real Estate Board.

In that area — which covers Surrey to Abbotsford, including Mission — first-time buyers made up about 30 per cent of purchasers.

Prices are also down slightly — 2.9 per cent — from last year in the Fraser Valley.

“[A drop of ] 2.9 per cent doesn’t create affordability,” Penner said. “A lot of that is the mortgage rates that are making it attractive.”

In the Fraser Valley home sales were down 11 per cent in September compared to August, which is not surprising in an area that usually sees sales cool after the summer months,” Penner said.

At the same time, prices edged up 1.6 per cent.

In both Greater Vancouver and the Fraser Valley, sales in September dwarfed September 2008, when banks were going belly up and the stock market started its downward spiral.

In the Vancouver area, September’s sales were more than double the 1,585 sales from a year earlier. And in the Fraser Valley, only 980 homes were sold last September, compared to 1,590 this year.

“The numbers are startling in comparison to last September,” Russell said. “But in all fairness, last September wasn’t the world’s greatest month.”

Both Russell and Penner called the market steady .

“I would say it’s healthy,” Penner said. “It’s not overheated by any means. It’s a nice strong pace.”

In the Vancouver area, inventories are rising and that should keep the market from overheating, Russell said.

“Inventory is building up and I think that’s healthy,” Russell said.

In the Greater Vancouver area, the benchmark price for a detached home was $741,632 in September, 2.1 per cent higher than last September’s average price of $726,331. The benchmark price for a detached home in the Fraser Valley was $491,404, 1.5 per cent below last year’s level of $498,822.

© Copyright (c) The Vancouver Sun