Loonie can buy lot of U.S. house

Garry Marr

Sun

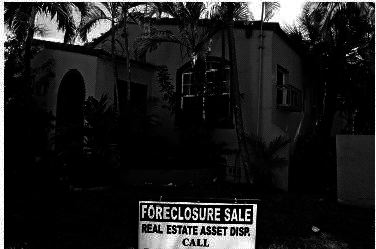

Housing prices have dropped dramatically in the United States but there are potential pitfalls for Canadian buyers. Photograph by: Joe Raedle, Getty Images, Financial Post

There is something about a bargain that few of us can resist. Is there any better sale going on right now than U.S. homes? The subprime meltdown has devastated the United States, leaving behind a sea of foreclosures and empty homes — all ready to be snapped up by frost-bitten Canadians with a red-hot currency.

The Washington D.C.-based National Association of Realtors says 23.6% of all international homebuyers in the United States last year were Canadian, up from 11% in 2007.

It’s no wonder. During the same period, the median price of U.S. vacation homes fell to US$150,000, for a 23.1% drop in price.

Tannis Dawson, a Winnipeg-based tax and financial planning expert with Investors Group, says Canadians are accustomed to looking to the United States for deals, so why should real estate be any different? But she cautions the ramifications of a property acquisition have to be carefully considered. “Every day I get one or two e-mails [about buying U.S. property]. I get way more calls than I ever used to,” Ms. Dawson says.

The first thing to consider before buying is how much it’s going to cost you to carry your property. A major component of your carrying costs will be property taxes and that’s a thorny issue in some states for foreign investors.

“In Florida, there is a maximum that they can increase property taxes for residents, but if you’re not a resident they can go higher,” says Ms. Dawson.

If you’re not renting out your property, there is no impact on your personal taxes. If you are renting, there is withholding tax on the income that has to be paid to the Internal Revenue Service on a monthly basis. The likelihood is your expenses will outweigh your income and you’ll get that tax back, but you still have to file a U.S. tax return. You then have to report the income on your Canadian tax return but you will get a foreign tax credit.

Another key consideration, especially if you’re buying a condo, is the financial situation of the building you’re moving into. The housing crisis has meant consumers have walked away from their units — and condo fees. If the apartment you’re buying is in a complex where 30% of the units are in arrears on their condo fees, the other owners are going to have to pick up the slack.

Then there are capital gains, which most Canadian investors are expecting to be based on today’s prices. In the United States there is a flat fee of 15% on capital gains to the U.S. federal government, not to mention any state tax. There is a also a 10% flat tax for non-residents.

You still want to go ahead? Forget about financing any property. It’s almost impossible for Canadians to borrow in the United States, so you’ll have to use cash.

None of this seems to be stopping Canadians who are now being targeted with advertising blitzes by the U.S. real estate industry.

Kimberly Kirschner, past president of Realtor Association of Greater Miami and the Beaches Inc., expects even more Canadian activity this year because of the low prices. “You can get a two-bedroom apartment on the beach for US$150,000,” says Ms. Kirschner, talking about a unit near Hollywood, Fla., a popular Canadian snowbird destination about 30 minutes north of Miami.

The maintenance cost, basically your condo fee, can easily top US$500 a month for that unit. Add in another US$5,000 in tax and you are well above US$10,000 a year to carry a US$150,000 unit. Rent the same property and it might cost you US$1,500 a month.

“People are betting on capital appreciation now that prices have gone down,” says Ms. Kirschner.

But should you take that bet? “I don’t think you buy a second property to make money,” says Halifaxbased financial planner Hugh Smilestone, who has a number of clients who own real estate in Maine.

Prices have dropped by about 10% in the region, not as much as the sunbelt, but it has encouraged some buying.

“I think a vacation property starts out as a luxury. I never tell people to count on it as an appreciating asset,” he says. But Canadians may be thinking otherwise these days.

Dusty Wallet Last week’s DW dealt with the risky practice of using your credit card for car insurance, noting the practice does not cover drivers for a number of risks that may arise from an accident. An alternative that one sharp DW reader pointed out is to get a special add-on to your regular car insurance. The addition lets you take the insurance from your car and transfer it to a rental car when you’re on vacation. The extra insurance is less than $100 per year on most policies. One drawback is the additional coverage is usually limited to the United States and Canada.

© Copyright (c) The Vancouver Sun