‘We jumped at the opportunity,’ young buyer says of half-million-dollar townhouse

Michael Sasges

Sun

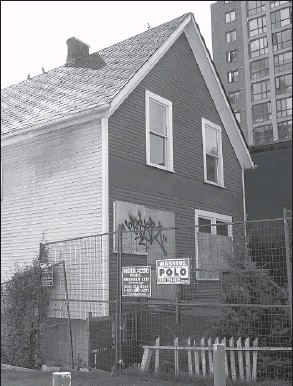

The Richards building will rise for 18 storeys above the northeast corner of Richards and Helmcken Streets — and above homes dating to Vancouver’s early days. Two of them will be rehabilitated by Aquilini Investments and relocated from their Richards Street site to Helmcken Street. The houses are for sale. By city hall’s count, 16 residences like them still remain downtown. Three of these are located around the corner from the Richards site. Moving the two Richards Street homes there ‘will form a representation of an early, historic, end-of-block development pattern once common in the area,’ in the words of a city hall document. The to-be-relocated residences were built in 1907 and 1908.

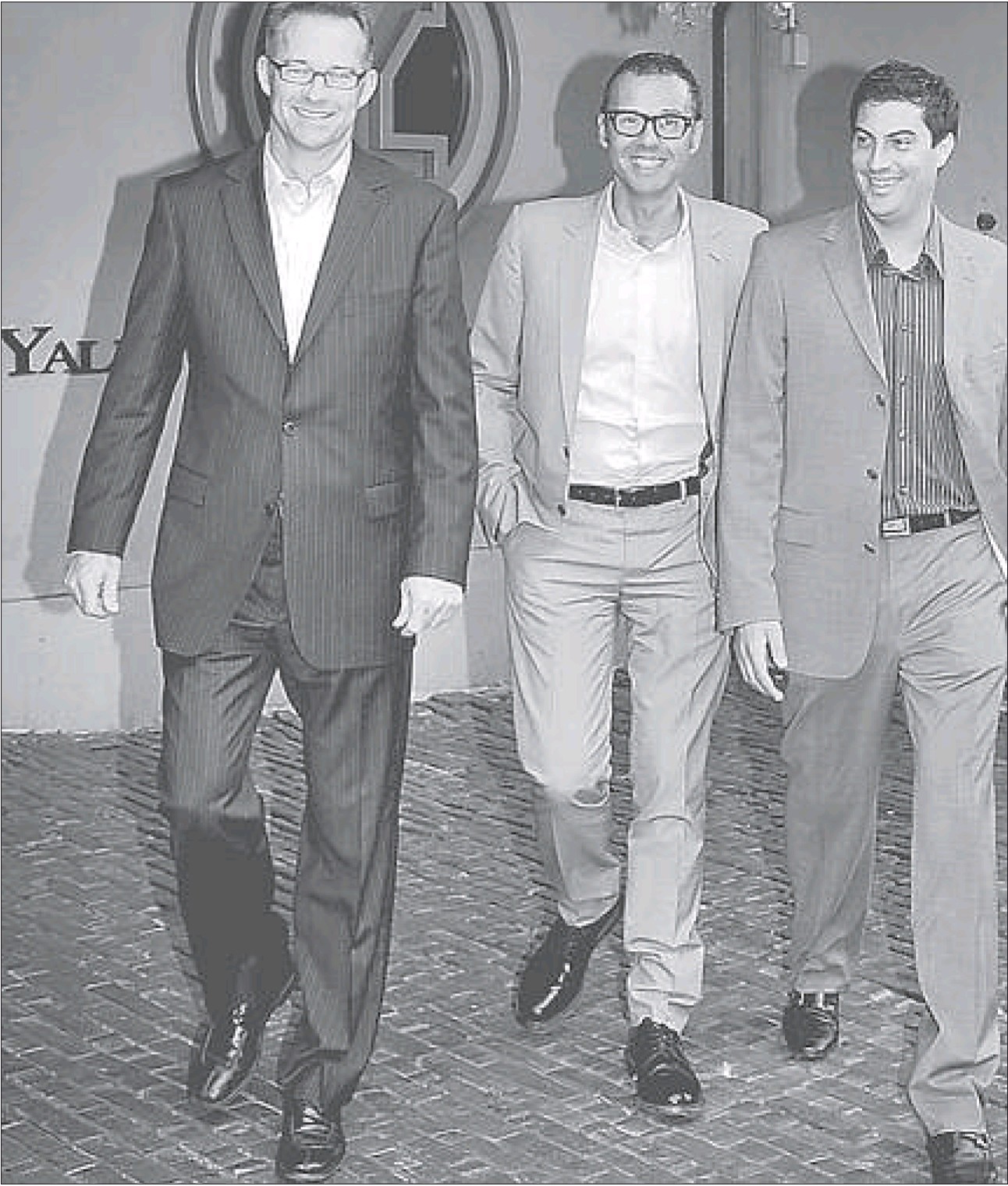

Bob Rennie, flanked by two Rennie Marketing Systems associates, president Tracie McTavish, left, and project manager Greg Zayadi, right, led Sun photographer Ian Lindsay down to the loading docks of the old warehouses on Mainland Street when he visited the Richards sales centre last September. ‘… we are really trying to sell proximity,’ Rennie said then, an observation as true today as it was 10 months ago. ‘Walk the life. This is a walk-the-life location, walk to work, walk to everything. This is right in the middle of getting to work and getting to a beer and getting to the seawalls. Whether you’re jogging or drinking or working, we can get you there.’

RICHARDS

Project location: Richards and Helmcken Streets, downtown Vancouver

Project size: 226 apartments and townhouses, two detached heritage homes

Residence size: Apartments, 553 sq. ft. to 885 sq. ft.; townhouses and penthouses, 900 sq. ft. to 1,315 sq. ft.

Prices: From $317,900

Sales centre address: 1066 Richards St.

Hours: Noon to 5 p.m.

Telephone: 604-688-2875

E-mail: [email protected]

Web: richardsliving.com

Developer: Aquilini Development

Architect: LDA

Interior design: Sheffield Design

Tentative occupancy: Fall 2011

– – –

When the Richards developer, Francesco Aquilini, and his broker, Bob Rennie, began to sell homes in the to-be-constructed downtown tower last September, their average asking price was just under $800 a square foot. Buyers were few.

Today their asking price is $585 and buyers are plentiful — about 160, as of this week.

One of them is Chris Breikss, 33. Owner of a downtown apartment and a downtown Internet-marketing business, the North Shore native recently bought a Richards townhouse for $499,900, plus another $3,000 for hardwood on the floors.

“My girlfriend [Kyla MacKinnon] and I looked a number of different places at Richards before deciding on a one-bedroom townhouse,” he said in an interview. “The townhouse is two levels and 900 square feet and features a layout that met our current and future needs.

“Downstairs, the living area provides enough space for a dining room table, which we currently don’t have. The downstairs also has a patio with space for a large barbecue and gated access to a shared green space that a potential pet dog could have easy access to for short walks or play time.

“Upstairs is a large bedroom and a big walk-in closet, which was a major selling feature for my girlfriend. The upstairs also has space that will be used for a computer room at first but could morph into an extra bedroom down the road.” As well, “there are two bathrooms, which is one more than our current 607-square-foot condo has, and that is an important upgrade.”

When a 100-per-cent increase in bathroom numbers and a 50-per-cent increase in floor space is the gain, something has to be given up, of course.

“We are using a line of credit at a very favourable rate for part of the down payment and plan to save over the next two-and-a-half years to pay as much down as we can before we move into the place.

“We are selling the sportscar for perhaps a more practical vehicle to help reduce current living expenses, too. In 2 1/2 years we plan to move into the new condo and live in it for at least a year while renting out our existing condo to help build equity.”

The couple currently live one block north of the Richards site and had been “keeping an eye on the development,” Breikss reports.

“When the price drop was announced, we jumped at the opportunity and visited the sales centre.

“We had been casually exploring other options for a bigger condo and wanted to move out of our starter home. We were having a difficult time finding something that met our needs in terms of location, size, layout and price, and Richards hit all [of these].

“The building design and finishings met our style and the common areas and amenities were particularly attractive, as well.”

The developer and broker also figured in Breikss‘ decision.

“Francesco Aquilini’s involvement in the development is important to us, as we are big Canucks fans and season ticket holders and believe in what he and his family have done in and for this city.

“Also, we trust Bob Rennie. He has a solid reputation for involving his company in quality real estate projects.

“Between Rennie and Aquilini, we feel they will meet, if not exceed, our expectations.”

Breikss did not volunteer his comments about Aquilini and Rennie unprompted.

He was responding to an observation by the latter about the former, offered in September when the sales centre first opened.

Rennie said Aquilini’s involvement means Richards buyers are buying not only from “a developer who’s been around, but a developer who’s going to be around” and, further, a developer “with a brand to protect, and we’ve seen developers in this market who have no brand to protect.”

When he and Rennie started to sell Richards units last fall, the retreat in the availability of credit in the United States was a year old.

The cause was hundreds of billions in mortgage investments gone bad. The consequences included Wall Street’s biggest crisis since the Depression; the nationalization of some U.S. banks and the failure of others; a $700-billion US credit-restoration program from the Bush administration and, in October, coordinated interest-rate cuts by the world’s leading central banks. (See the article “Credit Crisis — The Essentials” on the New York Times website.)

This month the OECD said the economies of Canada, the United Kingdom, France and Italy seem to have turned away from deterioration in April, while the U.S. economy and those of Germany, Japan, China and India have shown that the arrival of similar turning points is imminent.

Speaking about the aborted September launch in an interview last week, Rennie said: “As we came into the summer of 2008, everybody was pricing their building just a little bit higher than what sold last. And it showed that no building was going to sell for that price. They sold less than 30 units. The market just couldn’t take it.

“I don’t know if the value was ever there, but the market couldn’t take it because the world was rapidly changing as Richards opened.”

The September buyers all received their deposits back. All but one have recently re-purchased.

Rennie attributes June’s purchases to two causes — one regional, one specific to downtown. Construction costs have declined since the fall, enough at Richards to permit its developer to drop the average asking price by more than 25 per cent.

“I think that just as much as the developers had higher prices on their buildings, their construction costs were at an all-time high in the first half of ’08, and those were the prices everybody was relying on,” Rennie says.

“So he really, really got his construction costs in line.”

Second, the demand for a downtown Vancouver address, at least in the first years of the next decade, will be greater than the supply.

Also, new additions to the downtown residential inventory will probably be more expensive to develop because of a recent city council decision that limits the amount of downtown that can be used for residential purposes, a job-protection measure.

Rennie thinks value appreciation downtown is inevitable, even during construction of the Richards homes.

“Because downtown has such a short supply of inventory coming and inventory on the market during that two years of construction … if your life gets richer or poorer, you know you’ve got a great investment on your hands.”

Chris Breikss shares that hope. “We anticipate that the building will appreciate during the construction, but this was not a motivating factor. We hope it appreciates at a conservative rate — perhaps four per cent per year during the two-and-a-half years of construction.”

Rennie expects Aquilini to begin demolition of the existing buildings on the Richards property next month. The Richard’s on Richards nightclub has occupied one of the buildings for years.

“I think we will miss Richard’s on Richards, but the lustre had worn off the place in recent years,” Breikss says.

“We hope to find some memorabilia from the place and somehow incorporate it into the interior design of our new place.

“Our condo will be located literally where the shooter bar currently exists. Richard’s on Richards will be gone but not forgotten.”

© Copyright (c) The Vancouver Sun