Fractionally sold and bought, wholly thrifty

Suzanne Morphet

Sun

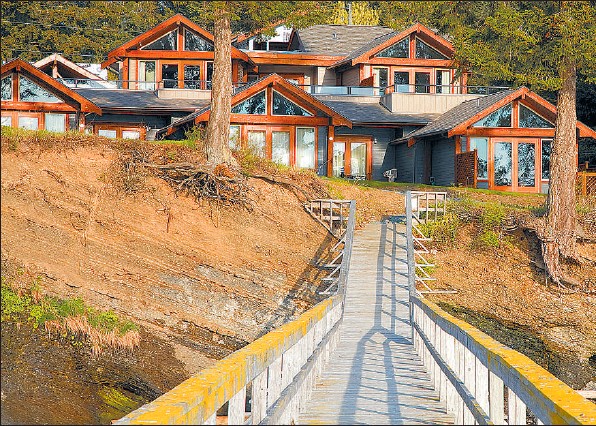

Who could walk from this? Kim Biehl thought about it – briefly – a response to a concern that the economic downturn might prevent or delay completion of the Mayne Island Beach Homes & Resort. Developer Murray Rosengren, below with wife Kim, reports that only two of 66 buyers did not complete. ‘ Our lawyers were telling us, ‘‘ you’ve done well, you’ve got a very good closing rate,’’ which speaks very well for the acceptance and approval of these units by the owners,’ Rosengren says.

Prices of a one-eighth interest in the title to a Galiano Inn and Spa residence ( left) range from $ 33,900 to $ 98,900. The developer hasn’t dropped prices from last year, but is offering purchase incentives this year. Among them is a break on maintenance fees for two years. For more information on Galiano Inn and Spa call, toll free, 1-877-888-1988. For more information on Mayne Island Beach Homes & Resort call toll free, 1-866-5395399 or e-mail jsquire@ sutton. com.

In December when economic turmoil made champagne the most unlikely of tipples, dozens of new property owners on Mayne Island cracked open the bubbly anyway.

Over the last two years — and they were heady, what-can-go-wrong years — these bubbly-inbibers — mostly from the Lower Mainland – had bought into a fractional-ownership property on picturesque Bennett Bay and called Mayne Island Beach Homes & Resort.

Developer Murray Rosengren was delighted that all but two of 66 buyers put up the remainder of their purchase price and showed up that December day to see their newly completed vacation digs.

“Our lawyers were telling us, ‘you’ve done well, you’ve got a very good closing rate,’ which speaks very well for the acceptance and approval of these units by the owners,” Rosengren says.

Kim and Ken Biehl were present at that ”meet and greet.” With the economy spiralling downward and completion of the first 10 cottages and the promised spa months behind schedule Kim Biehle was concerned Rosengren and partner Dave Hinton wouldn’t be able to get financing to finish the project, she recalls.

Biehl says she briefly considered walking away from the $8,300 deposit. “Briefly, I’ll admit, briefly that thought crossed my mind, but we let it go pretty quickly. It’s been a long-term goal; we could afford it.”

Affordability is the reason most often cited for the popularity of fractional properties.

Developer Rosengren likes to compare buying one-eighth of a Mayne Island Resort cottage, beginning at $59,900, to buying a car.

“I mean you’re not spending much more than you would be if you were buying a vehicle, and what’s that car going to be worth in four years and what’s your vacation property going to be worth?” he asks.

The president of Whistler Real Estate Company, the largest real estate company in the Whistler area, agrees that fractional ownership is more affordable, but Pat Kelly contends these properties don’t appreciate in the same way that single-owner properties tends to.

“I have yet to see any fractional real estate that has appreciated significantly in value in the last 10 years.

” . . fractional developers and time-share (developers) will always tell you it goes up in value, that there’s a ready secondary market for it. Well, I’m not sure they’re the best people to give you that information.”

Rosengren acknowledges that the cottages at his resort have not gone up in value and they have actually gone down, some way down.

“We’ve adjusted some of our prices significantly, that is true . . . people expect it in today’s market. An example, our most expensive unit sold last year for $98,000 and it’s currently offered at $88,000 . . . that is a fact.”

On average, prices at Mayne Island Resort have dropped by eight per cent. Rosengren is also dangling other incentives to attract new buyers. They can choose from a pair of electric scooters, a couple of kayaks or no maintenance fees for two years.

Rosengren is eager to please customers who’ve already bought in and who want to see the rest of the development, including the spa with indoor lap pool, finished: ”we’re not going to hold out for prices that maybe aren’t working.”

On neighbouring Galiano Island, the developers of the Galiano Inn and Spa have sold 60 of the 160 fractions available in the 20-residence beachfront resort.

They have not lowered prices from last year – prices range from $33,900 to $98,900 for a one-eighth share – but new buyers are being offered incentives.

They can take the developer up on financing, or choose between guaranteed leasing for some of the six weeks the property is theirs, or get a break on maintenance fees for two years.

“I think we weathered the storm quite well, I think we’ll be fine,” says Galiano Inn’s realtor Ian Watts, who says it can take years for fractional properties to completely sell out. “Absolutely, I know one in Whistler, they’ve been selling it since ’02.”

“Of course we’re looking forward to more owners, there’s no question of that,” says Connie Nordin, co-owner of the Galiano Inn and Spa, “but at this point we’re pleased that we can be fully operating for both the owners and prospective owners and guests.”

Being able to indulge themselves at the resort’s award-winning restaurant and spa is a comforting thought to buyers who want some pampering after the punishment they may have suffered on the stock market. In fact, Nordin says buyers make a point of comparing the two kinds of investments, telling her, “Yea, I could put it (money) into stocks again, but really, I’m not able to enjoy that. If I’m putting it into a fractional ownership I can enjoy it tomorrow.”

While buyers – and some developers – like to compare fractional ownership with other kinds of financial investments, it’s not a good idea, according to Ross Perlmutter, president of the Canadian Resort Development Association, a national organization representing developers of timeshares and fractional properties.

Perlmutter says fractional properties should be viewed the same way you would look at buying a membership in an golf or ski club.

“As an investment, you could definitely do much better with something more traditional such as treasury notes or blue chip stock, but you also wouldn’t experience the pleasures of the private golf club experience. The same could be said for buying an exotic sports car or a Harley; they might be good investments, but the real reason people purchase products like that is to enhance their ‘lifestyle portfolio.’ ”

Perlmutter is candid about the future value of fractional properties, especially if the economy continues to be unstable, saying it depends entire on the ability of people to sell them.

“If the realtors – or others in the resale market – understand the product and market it properly, they could hold their value.

”On the other hand, if the owners feel the need to unload them – for example, due to financial hardship – and they are willing to sacrifice them for half of what they originally paid . . . anything could happen.”

Perlmutter estimates about 300,000 Canadians own fractional properties and that about 120 resorts offer or have previously offered some form of shared ownership. Sales in Canada in 2008 totalled about $800 million.

He believes the market for fractionals is still growing and cites a recent announcement by Calgary-based Bellstar Hotels and Resorts of an Okanagan development.

On the coast, the developers of both the Galiano Inn and Spa and Mayne Island Resort are looking forward to summer and more buyers.

Mayne Island Resort is holding a grand opening this weekend. The Galiano Inn has scheduled a pizza party on the ocean-front terrace from a new wood-fired pizza oven.

Kim and Ken Biehl recently enjoyed their third visit to their property at Mayne Island Resort, and says they have no regrets. “Absolutely none, it was the right thing to do at the right time and it’s a great place.”

Suzanne Morphet is a freelance writer in Victoria and co-author of The Vancouver Island Book of Everything.

© Copyright (c) The Vancouver Sun