Trend tempers Metro Vancouver’s sky-high housing prices

Derrick Penner

Sun

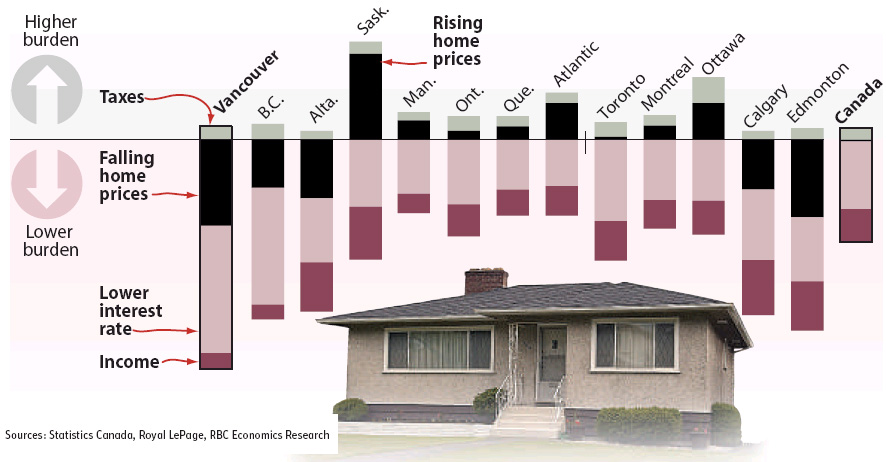

Lower interest rates, declining prices and slightly higher incomes all contributed to reducing the carrying costs of home ownership, according to RBC Economics’ latest Housing Trends and Affordability report. The graph illustrates how much each factor has contributed to the reduction between two periods, the last three months or 2007 and the last three months or 2008.

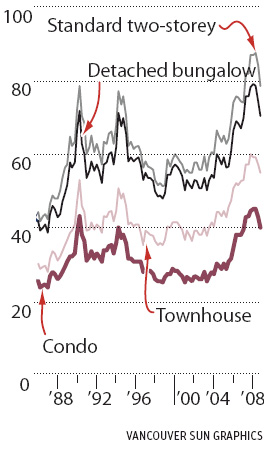

Percentage of household income taken up by ownership costs in Vancouver over the last 20 years.

Falling prices and mortgage rates lessened the burden of home ownership in Metro Vancouver at the end of 2008, but detached houses remain out of reach for most buyers in what remains Canada‘s most expensive real estate market, according to the latest measure by RBC Economics.

For condominiums, however, the monthly cost of ownership fell closer to the reach of more buyers on the so-called affordability measures in RBC’s Housing Trends and Affordability report released Thursday.

The carrying costs of buying an average Metro Vancouver bungalow worth $576,300 would have eaten up 70 per cent of the median family income in the fourth quarter of 2008, down from almost 75 per cent in the third quarter of 2008.

For the average, basic two-storey home worth $645,700, the measure slipped to 79 per cent from 84 per cent of median income.

The average standard condominium worth $327,500 came closest to the affordable reach of buyers, taking up 40 per cent of median family income, down from 43 per cent in the third quarter of 2008.

RBC senior economist Robert Hogue said the burden of paying for home ownership went down across the country, mostly because falling mortgage interest rates have pared back monthly mortgage payments.

However, in the higher-priced markets of Calgary, Edmonton and Metro Vancouver, the rapid descent of prices has also helped to appreciably reduce home ownership costs in those markets.

“Considering how much affordability [in Vancouver] had deteriorated over the last few years of the boom, we’re seeing the start of an improvement,” Hogue said in an interview.

“Clearly the current measures, even after having improved over the last year, are still well above the historical average,” Hogue said in an interview.

Historically, Hogue said, Metro Vancouver’s long-term average affordability measure for a detached bungalow is a cost that equals 55 per cent of the median family income.

“To me, at least, that indicates that there is probably more room to improve ahead,” he added, which will mean a continuation of the correction in prices.

Hogue said current conditions in B.C.’s economy — with rising unemployment and falling housing starts — are “poor underpinnings for the housing market.”

However, the RBC affordability measure needs to be viewed cautiously when applied to Vancouver because it doesn’t necessarily reflect what is happening in the market, said Tsur Somerville, director of the centre for urban economics and real estate at the University of B.C.’s Sauder School of Business.

Vancouver, he said, has always been very expensive relative to other Canadian cities, so residents, on average, have adapted by accepting that they will live in smaller homes.

“[The index] gets at how expensive land is,” Somerville said, “but the question we want [to answer] is not can people afford the same house as they can in Winnipeg, but can people in Vancouver acquire some type of owner-occupied real estate?”

In Vancouver, that owner-occupied real estate has rapidly taken the form of condominiums.

RBC calculates its affordability index on a quarterly basis as an indicator of whether housing markets in provinces and select cities are in balance or out of balance, Hogue said.

© Copyright (c) The Vancouver Sun