Our data will make it easy to determine if you should consider appealing

Don Cayo

Sun

Exclusive data allow owners to determine if the assessment on their home or business is fair and whether they should appeal. Photograph by: Glenn Baglo, Vancouver Sun

Win, lose or draw? Until now, there was no way to figure out how this year’s property assessment roulette will end when your tax bill finally arrives in July.

Now The Vancouver Sun is providing exclusive data, in this column and on our website, that make it easy to determine if the assessment for your home or your business is fair, or if you should consider appealing it.

Today’s column focuses on homes. I’ll be writing again on Saturday about the implications for businesses, many of which have a lot more money at stake.

The difficulty stems from a provincial decision to base 2009 property taxes on the lower of the last two annual assessments. Now, at The Sun’s request, BC Assessment has calculated the average impact in places across the province. By comparing the reduction in your assessment to the average in your community, you can tell if you have a lesser break, an equal break or a better break than others.

B.C. real estate prices have dropped in recent months, but many properties were holding their value, even gaining, in July when the second of these two assessments was done. Thus, for well over 80 per cent of all property owners, the lower of the two assessments is the one from 2007.

This means most tax bills will be based on lower values than they would have been without the intervention. But it doesn’t mean most tax bills will be lower.

The key is, how does your assessment compare with others in your community? If it went down by the average amount, the impact on your tax bill will be nil. If it dropped more than average, you’ll pay less than you would have. And if it dropped less than average or came in higher than in 2007, you’ll pay more.

Let me offer my own example.

The assessment for my West End condo in Vancouver is just one per cent less than it would have been without the provincial meddling. Meanwhile, Vancouver residences as a whole are reduced 6.25 per cent on average.

In other years, the biggest tax increases hit those whose property gains the most. So there’d be a break for me and my neighbours whose property values are similarly stalled. And for many other neighbourhoods — much of east Van, for example — that are also below average. (In general, “affordable” properties and neighbourhoods lost value first, so they’re most apt to lose as a result of this policy.)

But this year, thanks to the provincial meddling, the breaks go to the ritziest homes and neighbourhoods — to owners of the properties that gained the most in value. This isn’t fair. Yet — despite government lip-service to tax fairness — the odds of winning an appeal are anybody’s guess. It’s uncharted territory.

Usually appeals hinge on one thing: does the assessment reflect fair market value? But fair market value is no longer the point: the 2009 assessments are the product of political manipulation.

It’s quite right to argue that if this gives others a big break, it’s only fair that you get one too. But can you convince the politically appointed panel of amateurs who hear the appeals? Who knows?

Even without this uncertainty, I suspect many homeowners won’t bother to appeal when they factor in what they might win — in my case, about $150 — and what their time is worth.

Certainly the number of appeals seems likely to be down. Assessment experts like Paul Sullivan of Burgess Cawley Sullivan tell me they’re busy with regular customers, but not so many new ones. And BC Assessment says it has seen fewer appeals so far than in a normal year.

“People won’t understand how hard they’re hit until their tax bills arrive in July,” Sullivan said. And, with a Feb. 2 deadline to file an appeal, “that will be too late.”

The average percentage of reduction in residential assessments around the Lower Mainland and the Capital Region is in the single digits. Since the size of the hit depends on the gap between the change in your assessment and the average number, I’m guessing this policy won’t hit many of the region’s homeowners with extra costs of more than a few hundred bucks.

The story may be different in the Okanagan and the Interior. There, average changes are typically in the double digits and, in places like Revelstoke, Sparwood and Cranbrook, over 20 per cent.

If you own property in one of these communities, or if you’re one of the relative handful with a property that decreased in value between July 2007 and July 2008, you could potentially be hit hard.

Sullivan reckons that each percentage point of spread between your “break” and your community’s average will add roughly one per cent to your tax bill when it arrives in July. So if the figure is four per cent for your assessment and 10 per cent for the average, your bill will be about six per cent higher — $120 on a $2,000 bill — than it would have been without provincial interference.

Homeowners will have to look at their own numbers to decide if it’s worth appealing. But businesses face much larger costs, especially in the Lower Mainland. More on that Saturday.

HOW YOU COMPARE

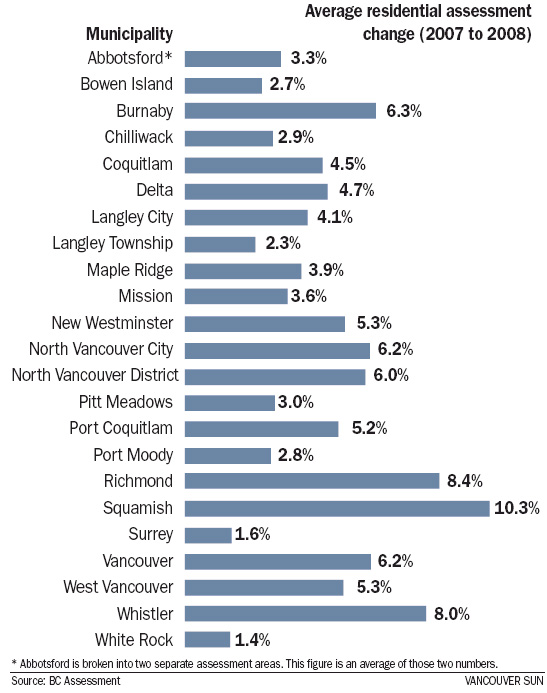

The table on this page may be enough to let you figure out if you’ll fare well or be hammered by the change to property assessment practices this year.

Homeowners from outside the Lower Mainland and business owners should consult The Sun’s interactive web page. It lists averages for both business and residences in most B.C. communities, and it includes a calculator to help you figure out the percentage of change on your property.

However, if you know this number and if you have a residential property in the Lower Mainland, all you have to do is check the chart on this page and compare your percentage to the average for your community.

If the two figures are nearly the same, the new policy will have no impact on you. Your tax bill will be close to what it would have been without the new rules. (This doesn’t mean it will be the same as last year — that depends on whether your council increases or controls its spending. And it’s a safe bet they’ll increase it.)

If the change in your property’s value was less than average, you’ll pay more than you would have. And if your change was more than average, you’ll get a break. In both these cases, the wider the gap the greater the impact.

SHOULD YOU APPEAL YOUR PROPERTY ASSESSMENT IN LIGHT OF THIS YEAR’S ‘FREEZE’?

In a normal year, homeowners whose property went up in value faster than others in their city would end up with a bigger-than-average increase in their municipal tax bill. But this year the B.C. government decided to allow property owners to use the lower of the last two year’s assessments as the basis for their 2009 property tax bills.

That means — for this year only — homeowners whose property values went up faster than average are actually better off than those with more modest increases. To find out whether you’re better or worse off under the assessment changes — and to help you decide whether or not you should appeal — follow these two easy steps.

STEP 1

Calculate the percentage increase or decrease for your own property assessment between July 1, 2007 to July 1, 2008, using the assessment notices you received from BC Assessment. To calculate the increase/decrease, subtract your July 1, 2007 property assessment from your July 1, 2008 assessment. Then divide that number by your July 1, 2007 assessment and multiply that number by 100. For example, if your 2007 assessment was $500,000 and your 2008 assessment was $550,000, the math would work like this:

$550,000 – $500,000 = $50,000

$50,000 / $500,000 = 0.10 x 100 = 10%

STEP 2

Look up your municipality in the accompanying chart to see what the average property-value increase was in your community. If the increase in your assessment is greater than the average, you’re better off than most. However, if your increase is smaller than average, you are worse off as a result of the policy change. If the value of your property actually went down between 2007 and 2008, you are particularly worse off. You have until Feb. 2 to file an appeal to BC Assessment, which you can do online or by going to your local assessment office.

© Copyright (c) The Vancouver Sun