Anna Bahney

USA Today

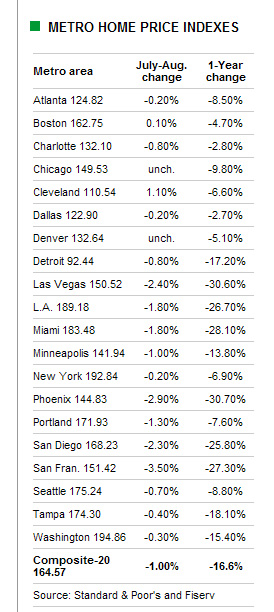

The median price of a single-family home in August was 16.6% lower than in August 2007 and has fallen 20.3% from the price peak in July 2006, according to the widely followed Standard & Poor’s/Case-Shiller index of 20 metropolitan areas. Prices dropped only 1% from July.

The decline from the year before was a record fall for the 8-year-old index of 20 cities, and it was the fifth-consecutive month that all of the cities saw price declines from the year before.

Among those with the biggest annual drops were Phoenix and Las Vegas, with prices falling more than 30% from last August. Miami, San Francisco, Los Angeles and San Diego all had price declines of more than 25% from last August.

But the steep declines in those areas are countered by more moderate annual price drops in areas such as Dallas and Charlotte, which are down only 2.7% and 2.8%, respectively, from August 2007.

Despite the year-to-year declines, two cities, Cleveland and Boston, saw prices rise slightly from July to August. Boston has had price increases from the month prior in each of the last five months.

“Affordability is coming back into markets all across the country,” says Joel Naroff, an economist at Naroff Economic Advisors. “That should generate additional sales and stabilize prices. If only people could get mortgages. The biggest impediment in the market is the ability to get mortgages.”

He anticipates a further drop of only 5% to the bottom. “Peak to trough I don’t see us dropping 30% by any means,” Naroff says. “I could see 25%, but I wouldn’t be surprised if we don’t get that much.”

Other experts forecast a steeper fall from the peak, with a remaining 10% or more decline coming slowly into next year and beyond. From the top to the bottom, “Expect a total fall of 30%,” says Ian Shepherdson, chief U.S. economist for High Frequency Economics.

“If we have incremental declines every month, it will take until 2010 to reach the total 30% drop,” says Suzanne Mistretta of Fitch Ratings. She adds that the run-up in prices from 2004 to the peak in 2006 has been unwound and prices are currently at 2004 levels. She expects prices will go lower, down to 2003 levels.

“The monkey wrench in all this is the possibility of worsening macroeconomic conditions and jobs,” she says. The 30% drop from the peak, “doesn’t take into account significant deterioration in the economy.”