There’s a light at the end of the housing tunnel, but it’s faint

Harvey Enchin

Sun

Your home may still be your castle, but it’s not worth what it was yesterday.

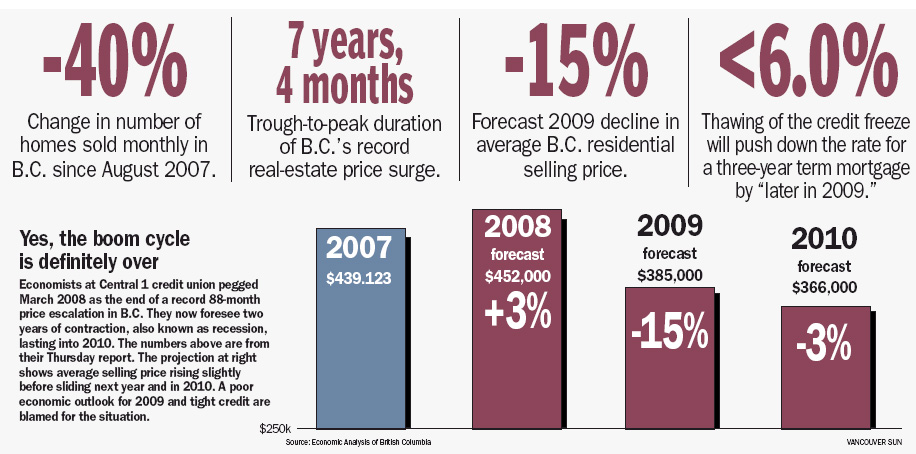

The latest housing outlook from Central 1 Credit Union economist Helmut Pastrick will not please homeowners, but would-be buyers can look forward to falling house prices in the months to come.

With residential sales expected to drop 30 per cent this year and another 18 per cent in 2009, median prices have declined by 12 per cent since last March and are likely to fall another 13 per cent in 2009 and a further five per cent in 2010, assuming market conditions begin to improve by then, the report says.

That might be a slightly optimistic timeline.

Vancouver is no stranger to real estate booms and busts. Given the uninterrupted advance in prices since the third quarter of 2002, it’s easy to forget that house prices rise and fall in tandem with the economy.

Residential real estate was a good place to be in 1975 when the average price of a detached home was $67,500 in nominal dollars. (The real-dollar equivalent would be $264,508, but we’ll stick to nominal dollar values in this column). By the first quarter of 1981, the price had nearly quadrupled to $233,500 with barely a hiccup in the interim. Then a long recession took the stuffing out of the real estate market. By the fourth quarter of 1982, the average price had fallen to $150,800, a drop of 35 per cent from the peak. And that wasn’t the worst of it. Housing prices did not recover until 1989.

The euphoria didn’t last long. After prices rose to $324,700 in 1990, another dip in the midst of an economic slump shaved 12 per cent from the average price by the first quarter of 1991. It took more than a year to recover to $329,000 in the second quarter of 1992.

The advance resumed until 1995 when prices topped out at $418,100 and a modest economic correction cut the average price by 7.5 per cent to $386,500 in 1996. Prices bounced around erratically for a time but finally turned the corner in the fourth quarter of 2000.

It sounds unbelievable but it was eight — count ‘em, eight years — before Vancouver prices surpassed the 1995 level. Finally, in the first quarter of 2003, the price reached $434,700 and never looked back — that is, until now.

Vancouver‘s housing history suggests prices can drop sharply and suddenly and take many years to rebound. Deflate today’s average price of $759,000 to factor out inflation and the real price comes to $193,689, suggesting an annual appreciation of 5.6 per cent if you held your property from 1975 to the present.

The University of B.C. Centre for Urban Economics and Real Estate (which compiled the statistics used above) has calculated Vancouver’s house annual appreciation over various periods: 1979-2008, 7.6 per cent; 1981-2008, 4.4 per cent; 1992-2008, 5.3 per cent and 2001-2008, 10.2 per cent.

It is clear that home ownership is not the high-yield road to riches. However, residential real estate is, for most people, the largest component of net worth.

Pastrick states the obvious when he says in his report that current market conditions are consistent with a housing recession and falling prices. But he notes this follows the longest expansion on record, one that drove prices up 100 per cent (in current dollars) from trough to peak.

The average price-cycle recession phase lasts 39 months, he says, but can be within a wide range of nine to 65 months. The housing market will turn around when supply no longer satisfies demand. With housing starts due to fall sharply over the next year or two, residential construction projects postponed because of financing difficulties, and improving affordability as a result of falling prices, there is a light at the end of the tunnel — but it’s faint and distant.

© The Vancouver Sun 2008