Potential oversupply looms in province, CMHC warns

Derrick Penner

Sun

British Columbia’s recreational property markets, mirroring primary-residence markets, are experiencing moderation with fewer sales, more listings and slower price growth, realty firm Royal LePage found in its latest analysis of leisure real estate.

“Recreational real estate is obviously a luxury purchase versus a basic necessity,” Phil Soper, CEO of Royal LePage Real Estate Services, said in an interview.

“As such, when people’s … confidence in their ability to continue purchasing things like luxury properties wanes somewhat, they tend to put off [those] purchases.”

At the same time, Soper noted that Canadian recreational markets have been “the most supply-constrained” of any market sub-components, which makes this year’s rise in listings welcome compared to previous years.

However, in B.C., particularly the Okanagan, developers are approaching potential oversupply, according to a Canada Mortgage and Housing Corp. analyst in the region.

“I don’t think we’re quite there yet,” Paul Fabri of CMHC said in an interview.

Demand for property in the region is still strong, Fabri added, though it has been drained somewhat by greater competition from the U.S., where builders in the grips of a housing recession are unloading properties at significant discounts.

Also, fewer Alberta buyers are coming into the Okanagan because some of them in Edmonton and Calgary have witnessed the equity in their primary homes shrink as their markets cool, leaving them with less leverage to take on second homes.

“And a lot of pent-up demand [for recreational property] has been satisfied,” Fabri added, “because [developers have] brought so much on stream.”

However, Fabri said that to date, he hasn’t seen any price reductions on Okanagan leisure real estate.

Riley Twyford, broker-owner of Royal LePage Downtown Realty in Vernon, said overall sales in his area are down about 29 per cent from the previous year.

“Prices aren’t going backward,” Twyford said in an interview, “but it’s a lot different market for sure.”

Twyford added that the recreational market is “a spinoff from the other marketplaces.”

“When markets are active in Vancouver, Calgary, we get the spinoff. When it’s less active [in those cities] it’s going to be less active for our marketplace as well.”

The Royal LePage report was based on analyses of two sets of data — a survey of Royal LePage offices in 53 individual markets across Canada to gauge market activity, and a national poll of 3,000 individuals to measure the intentions of Canadians around buying recreational real estate.

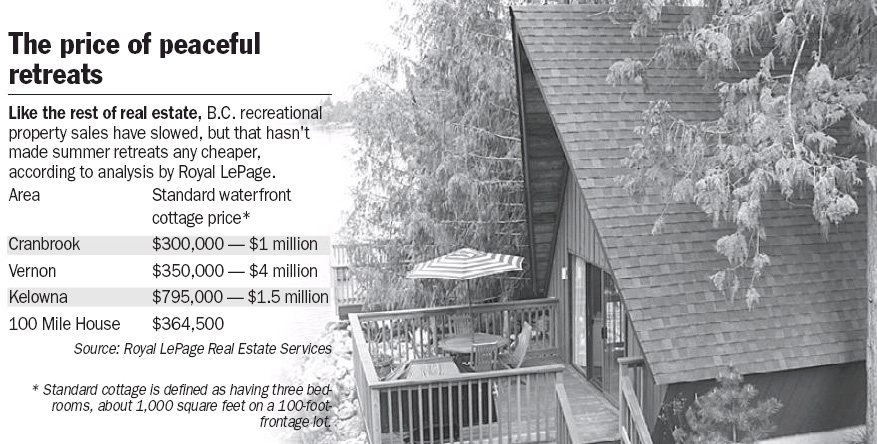

In B.C., the survey included assessments of Cranbrook, Vernon, Kelowna and 100 Mile House, where Royal LePage offices were asked to gauge a range of typical property values based on early-spring 2008 sales compared with the previous year.

In Kelowna, the most popular properties are resort-style condominiums, said Royal LePage broker-owner Wade Webb.

Philip Jones of Royal LePage East Kootenay said sales of recreational properties have slowed around his area in Cranbrook, but the frenzied pace of recent years was unsustainable.

“Having said that, we recently had a sale at one of our lakes and [the sale price] was $1.3 million. It seems like prices are remaining strong, but the level of activity is more reasonable.”

A lot of the buyers, he added, are young families with fathers and mothers who have done well in the Calgary-based oil industry.

In 100 Mile House, Royal LePage realtor Melvyn Grahn said standard waterfront cottages are trading at lower prices in 2008 with an average price of $364,500, compared with $380,000 in 2007.

Prices for water-access cottages averaged $249,900, compared with $237,000 in 2007.

On the survey side of the Royal LePage report, the poll found young professionals made up the largest group considering a recreational-property purchase. A majority of them felt a cottage was a better long-term investment than stocks or bonds.

The rising price of gasoline was a factor in a growing minority of decisions about purchasing or cutting back on summer trips to the cottage.

Some 19 per cent of cottage-owning respondents said they would consider selling their properties if gas prices rise any higher. About one-third said high fuel costs will cause them to reduce trips they make to their summer retreats.

© The Vancouver Sun 2008