Paying two mortgages for CLOSING THE DEAL short period of time makes sense to many

BEV CLINE

Sun

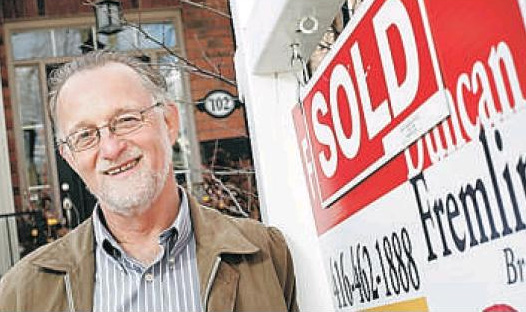

Duncan Fremlin is a real estate broker who is in the midst of downsizing to a new house while selling his old house.

For eight days this spring, Duncan Fremlin will be the proud owner of two homes in downtown Toronto. An empty nester, Fremlin and his partner Karen Laing are in the midst of downsizing, moving from a three-floor, four-bedroom place whose top floor gets “visited once a week for cleaning” to a more modest twostorey home just blocks away.

The couple want to spruce up their new home prior to moving, and as a result, they are joining the thousands of Canadians who choose to finance two homes at the same time.

Fremlin, a broker with Re/Max Hallmark Realty Ltd. in Toronto, estimates that close to 90 per cent of his clients opt for at least a few “moving days” between packing up and unpacking at their new digs. He says this is very different from when he started in the real estate business 21 years ago. In those days, Fremlin says, it was “taken for granted that you closed the deal on your old home and your new one on the same day.”

Interests rates were high at the time — approaching 14 to 15 per cent — so “very few people wanted to carry two mortgages at the same time, even for a couple of days. And lines of credit were quite hard to obtain.”

Times have changed. “Today we have low interest rates. There’s a shift in mindset on the part of the public towards a less stressful moving experience. In addition, lenders have been quite creative in creating new products.”

As a result, fewer people “are scrambling to get the legal paperwork done, hand over keys, and cart their belongings out of, and into, two homes all in a single day.”

This has necessitated alternate ways of thinking about financing.

People who are “buying up”, or purchasing a more expensive property than they currently own, generally will require bridge financing.

Many people think the term refers to having two mortgages simultaneously. But the meaning “as the banks use it, is that you own a property with a mortgage that you are living in. You buy a new property before you close your sale of the old one, and therefore, require a bridge loan,” says Lois Volk, a mortgage consultant with Invis in Toronto.

It works like this: You have a mortgage on your existing property, the lender sets up a new mortgage on the property you are buying, and the lender gives you a loan “because of course you don’t yet have the equity from the first property to finance the purchase of the second one,” says Volk.

People who are downsizing and will not require a mortgage on the new property, on the other hand, might find lenders reluctant to provide a bridge loan. Subject to qualification, however, consumers can put a line of credit on both properties. Often the property being sold has little or no financing on it, and a line of credit can often be obtained for up to 80 per cent of the value of the property, says Volk. The line of credit should be set up before the sale of the property.

One scenario might be that your existing home is worth $600,000 and you are purchasing a home worth $400,000. Your existing property has little or no mortgage and you will not need a mortgage after the sale of your home. Then you would arrange a line of credit on your existing property for up to 80 per cent or $480,000 and the line of credit on your new property if necessary, and the buyer will have enough to close on the new property.