B.C. market still healthy as people ‘steadfast in their determination’ to own, report says

Joanne Lee-Young

Sun

First-time buyers find way to get a home

Despite continuously rising prices, first-time homebuyers are still finding ways to get into the market, real estate firm Re/Max said in a report Tuesday.

Even if it means sacrifices such as purchasing a smaller property, taking longer to pay it off, or living in a less-than-ideal location, buyers “remain steadfast in their determination to purchase a home,” the report said.

In B.C., that is still translating into some multiple offers, and homes selling over asking price, said Karel Palla of Vancouver-based Re/Max Select Properties. But these are much fewer in number as “we head toward more normalcy,” he said.

“The market continues to be healthy, but we aren’t seeing the same urgency,” Palla said.

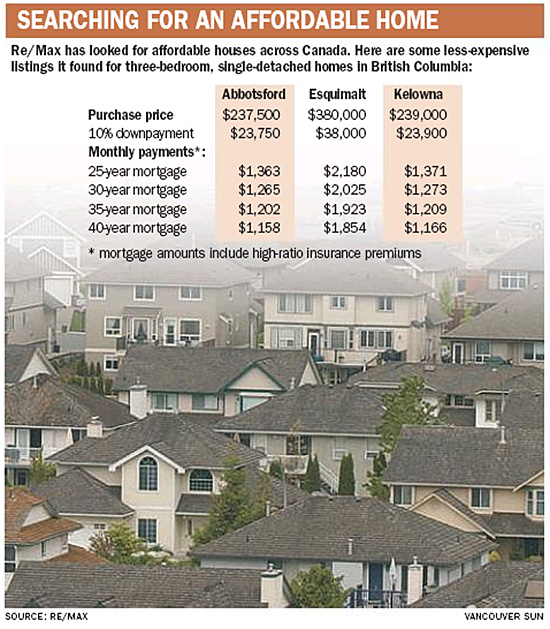

Re/Max estimates about 35 per cent of home sales in Greater Vancouver involve a first-time buyer. But with the average home price in the area now more than $600,000, buyers looking for affordability may want to look elsewhere. For example, a three-bedroom detached home can still be found in Abbotsford for as little as $237,500 and in Surrey for $279,000, the report said.

In Victoria, the average home price has eclipsed $500,000, but 62 per cent of sales went for less than that, as first-time buyers focused on entry-level condos under $250,000, Re/Max Camosun’s Wayne Schrader said.

In Kelowna, where the average price of a home is close to $500,000, first-time buyers are also considering alternative locations, the report said. But only 29 per cent of homes sold so far this year have been below the average price. While inventory levels have improved compared to a year ago, there is still a shortage of starter properties listed for sale, the report said.

Helping with affordability is lower interest rates, with the Bank of Canada again cutting its overnight lending rate on Tuesday, a move immediately reflected in variable mortgage rates and usually followed by fixed rates.

Buyers are also increasingly turning to “innovative financing,” with longer amortization periods — now as long as 40 years, up from 25 years — being used by 62 per cent of first-time buyers, the report said.

While that may conjure comparisons with loose-lending standards in the United States’ subprime-ravaged housing market, Michael Polzler, Re/Max’s regional director for Ontario and the Atlantic, said mortgage qualifications remain tougher in Canada.

“If the client is perceived of being a risk in Canada, it’s much harder to get this type of financing,” Polzler said.

And while longer-term mortgages may mean people are paying for their houses beyond retirement, such measures let younger buyers get a toehold in a real estate market that’s been on a seven-year bull run and is only now easing slightly, Polzler said. The Canadian Real Estate Association recently reported sales fell 7.1 per cent in the first quarter of 2008.