It now takes 75 per cent of median income to buy a two-storey home

Derrick Penner

Sun

VANCOUVER — After years of real-estate price increases rising faster than incomes in Metro Vancouver, housing in the third quarter of 2007 became the most unaffordable on RBC Financial’s measure…

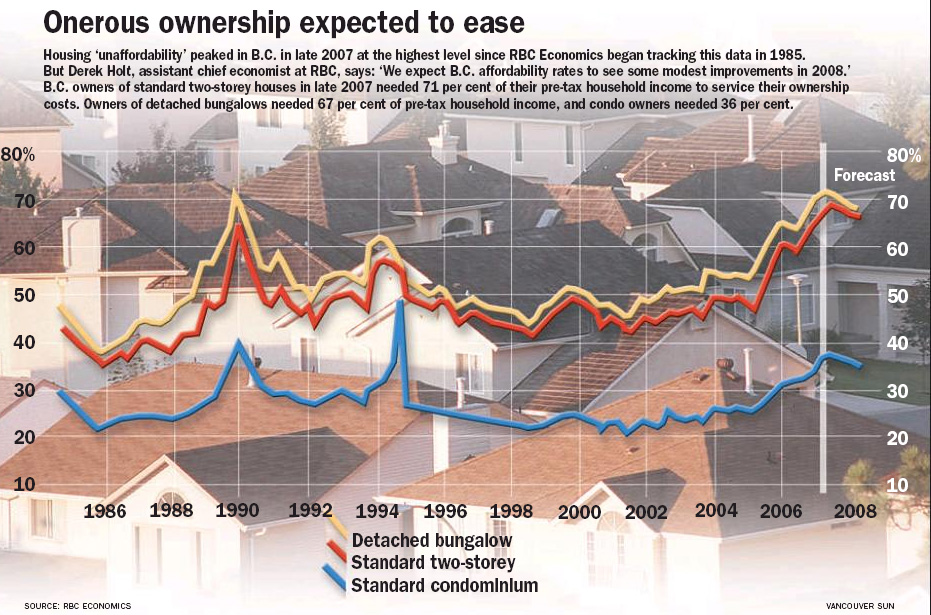

After years of real-estate price increases rising faster than incomes in Metro Vancouver, housing in the third quarter of 2007 became the most unaffordable on RBC Financial’s measure of affordability since 1985, when the bank first started keeping track.

Housing costs “hit all-time highs in the Vancouver market and the broader British Columbia market,” RBC Financial economist Amy Goldbloom said in an interview.

Detached houses were the least affordable option on the RBC index. The average two-storey house in Metro Vancouver carried a $619,892 price tag, requiring 75 per cent of the region’s median pre-tax household income of $60,000 to make the mortgage payments and pay taxes and other ownership costs.

In the second quarter of 2007, it took 73 per cent of the median income to cover those costs.

Provincially, the average two-storey house, priced at $542,012, required almost 71 per cent of the median pre-tax income to pay all its costs, up from 68 per cent in the second quarter. The RBC index assumes a 25-per-cent downpayment and 25-year amortization.

“We do think [unaffordability] last year reached a peak,” Goldbloom added. “People are just getting priced out of the market,” and that factor will cause the demand for housing to wane a bit.

And the RBC report reinforces the shift Metro Vancouver has seen with more people forced to consider multi-family housing over single-family homes because of price. In 2007, condominiums and townhouses accounted for 80 per cent of all new housing starts.

Because houses are not affordable, “people are just buying condominiums instead of houses,” Tsur Somerville, director of the centre for urban economics and real estate at the University of B.C.’s Sauder School of Business, said in an interview.

The RBC affordability index for the third quarter showed that an average Metro Vancouver condominium, priced at $298,787 would eat up almost 36 per cent of that median household income.

B.C.-wide, an average condominium, priced at $271,468, would use about 34 per cent of the medium income to maintain payments, taxes and other fees.

“The [RBC] index tells us levels of affordability are way out from what we normally expect them to be,” Somerville added.

However, while RBC is forecasting the unaffordability of Metro Vancouver and B.C. housing to ease in 2008, in part because high prices will reduce demand, Somerville doubts that Metro Vancouver’s affordability measure will ever see the median income catch up with house prices.

He said the combination of population growth and limited land supply will still keep houses out of reach of median-income buyers.

“There’s no reason to expect [Metro Vancouver] to have anything other than the highest unaffordability in the country,” Somerville said.

The high cost of housing nationwide is a big concern of municipal governments. The Federation of Canadian Municipalities, in a report released Wednesday, warned that a lack of affordable housing is becoming an economic threat to cities.

Vancouver Mayor Sam Sullivan said too many families here are having to choose between buying food or making the mortgage.

Sullivan, during a media scrum following his annual state-of-the-city address to a Vancouver business group, said that on one hand, the city’s high prices are an indication of the investment people are pouring into Vancouver which points to its success.

“On the other hand, it does require us to work harder to provide more affordable housing,” he added.

Sullivan said the city’s so called EcoDensity proposal aims at finding ways to increase the housing supply.

“If we were to develop lane housing or suites that are smaller in neighbourhoods that are perhaps near transit corridors we’d have more options for people who want to buy housing in this city,” Sullivan added.

Atlantic Canada and Manitoba had the most affordable housing on the RBC index. Examples of the relative affordability of a detached two-storey house and proportion of the median pre-tax income required to maintain are:

– Atlantic Canada: $207,222, 34 per cent.

– Manitoba: $220,549, 35 per cent.

– Toronto: $481,315, 52 per cent.

– Calgary: $476,711, 45.7 per cent.

© The Vancouver Sun 2008