CONSUMER SPENDING: Foreclosure surge alarms Congress

Agence France-Presse

Province

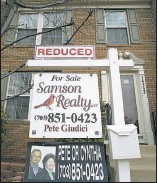

‘For Sale’ is sign of times in Centreville, Va., yesterday as March home sales plummeted to dash hopes of U.S. markets rebounding any time soon. — AFP

WASHINGTON — U.S. home sales plummeted dramatically last month, marking the biggest monthly fall in over 18 years and dashing hopes the market was poised to rebound, new industry figures showed yesterday.

The National Association of Realtors said existing U.S. home sales sank a heavy 8.4 per cent to an annualized pace of 6.12 million units in March, well below most forecasts that had predicted sales of 6.45 million units.

U.S. apartment and home sales had been expected to drop in March, but the decline was much worse than anticipated and some analysts said it would ratchet up pressure on the Federal Reserve to cut interest rates.

“Ugly is the simplest word for this report,” said Joel Naroff of Naroff Economic Advisors, who advises financial firms on economic matters.

The drop in homes sales was the largest since January 1989 when sales dived 12.6 per cent, and sales are now at their lowest ebb since June 2003.

NAR’s chief economist David Lereah said the market had been buffeted by cold weather and worries about spiking home foreclosures. “For the last couple months we’ve been expecting a weather ‘hit’ on home sales finalized in March,” Lereah said.

“We also may be seeing some losses as a result of the subprime fallout,” he said, referring to mortgage loans granted to home buyers with patchy credit records.

The sharp decline in sales, which affected most regions, came after sales had risen for three straight months, raising hopes that the market downturn was bottoming out.

But the March figures destroyed such hopes and Naroff said fresh drops could still occur. “How much lower the housing market can go is unclear, but it is not likely that we have seen the bottom.”

Sal Guatieri, an economist at BMO Capital Markets, said: “The key risk remains that further declines in home prices will eventually undermine consumer spending, tipping the economy downwards.”

Concern about the housing downturn, which started last year following multiple years of redhot growth spurred in part by a speculative binge in some cities, is troubling Congress.

U.S. lawmakers are voicing alarm about surging home foreclosures, over 500,000 mortgages were in foreclosure at the end of the fourth-quarter 2006, and are debating ways to boost policing of mortgage lending.

Lawmakers worry that rising foreclosures could worsen the already year-long housing slump and derail the world’s biggest economy.