Pool of buyers who can afford to get into market is shrinking

Derrick Penner

Sun

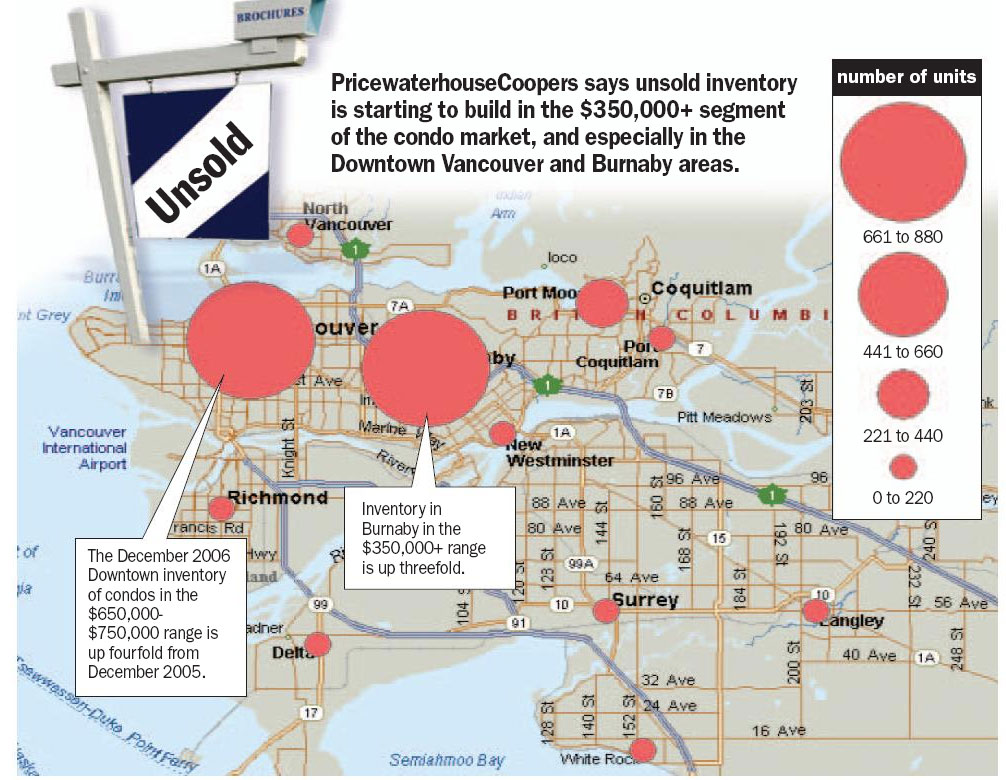

The rising inventory is likely because fewer buyers can afford to pay Vancouver’s high-flying prices, Craig Hennigar, vice-president of PricewaterhouseCoopers Real Estate, said. Photograph by : Vancouver Sun graphic

Greater Vancouver real estate markets saw a 55-per-cent increase in inventory of unsold pre-sale condominium units over the last six months, which may trigger a slowdown in future development, PricewaterhouseCoopers reported Thursday.

The rising inventory is likely because fewer buyers can afford to pay Vancouver’s high-flying prices, Craig Hennigar, vice-president of PricewaterhouseCoopers Real Estate, said.

However, Hennigar added that developers will likely build the projects they have in the works now, then scale back their future expectations rather than drop prices that are being driven largely by skyrocketing land and construction costs.

“We’re not suggesting, at this point, that the market is awash in unsold presales,” Hennigar said.

The 4,350 unsold condos across Greater Vancouver that PwC counted at the end of December in its semi-annual condominium market review compared with 2,780 unsold units that were counted at the beginning of 2006.

However, Hennigar said the proportion of pre-sale units available that have not sold has not increased dramatically. In the highrise category, PwC estimated that while unsold inventory increased to 2,270 from 1,300, the number represented only 28 per cent of all units in pre-sale.

The 1,300 counted last January represented 23 per cent of all units.

Hennigar added that 50-per-cent unsold would represent a balanced market, and the overall market isn’t approaching that figure.

“But we’re closer to [50 per cent] than we were six months ago, or 12 months ago when the market was hotter,” he said.

Hennigar added that the rise in inventory seems to correlate with a 30-per-cent rise in condominium prices, which far outpaced income growth of potential buyers.

So while immigration and economic growth is adding to the pool of potential buyers, the “pool of buyers that can afford to buy is probably being diminished by the increase in prices.”

Hennigar said that in high-rise condominiums, the biggest increases in inventory of pre-sale units are in Vancouver and Burnaby, where prices have also become extremely high.

The PwC market review found that average high-rise prices hit $800 per square foot in downtown Vancouver. The median high-rise price across Greater Vancouver hit $500 per square foot. Most unsold units — 900 — were in the $350,000-$450,000 range.

Low-rise condominiums had a pre-sale inventory of just over 1,000, with a median price of $325 per square foot. The biggest concentrations were in Vancouver, Burnaby and South Surrey, and most were in the $250,000-$350,000 range.

PwC found an inventory of almost 50 per cent among townhouses, with just under 1,000 unsold, and concentrations in south Surrey and Maple Ridge with most in the $250,000-$350,000 range.

Tsur Somerville, director of the centre for urban economics and real estate at the Sauder School of Business at the University of B.C., said rising inventories of pre-sale units is consistent with recent stories about the overall slowing market.

“We’re at a stage where there are a lot of units under construction,” Somerville said. “And to the extent they’re not 100-per-cent pre-sold … the market looks a lot weaker.”

Somerville added that it is hard to know how many unsold pre-sales would be too many. If it’s a three-month backlog of units, he said it is not significant. If it’s a year’s worth of unsold pre-sales at existing sales rates, “that is a big deal.”

Hennigar said prices in the current environment are unlikely to drop, even though the pool of buyers able to afford units is shrinking, because developers can’t build condominiums at lower prices.

“If they’re finding that they’re having difficulty moving product, instead of trying to push product at a lower profit, they might just scale back their development expectations,” Hennigar said.

However, Somerville said that will also depend on whether any developers wind up with unsold inventory at completion and construction loans that haven’t been paid off.

“When you look at what drives markets down, it’s people who are under pressure to sell, or are trying to liquidate before they think there’s a bigger loss,” he said.

Hennigar added that while the inventory of pre-sale units is rising, the number of completed, vacant and unsold condominiums is still very low — 151 across all of Greater Vancouver at the time of the market review.

“We’re definitely not in a buyer’s market,” Hennigar said, “and if developers are careful about what they’re doing, we won’t get there.”

© The Vancouver Sun 2007