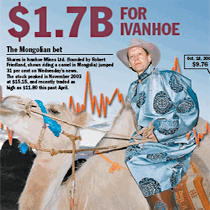

The deal will finance Ivanhoe’s key Mongolian project

Drew Hasselback

Sun

London-based Rio Tinto PLC interest is a major shot in the arm for Ivanhoe. Photograph by : Vancouver Sun Illustration

Ivanhoe Mines Ltd. received a much-needed credibility boost Wednesday after one of the world’s biggest mining companies acquired the rights to purchase up to 40 per cent of the Canadian miner.

London-based Rio Tinto PLC, the world’s second-largest miner by market value, Wednesday bought about 10 per cent of Ivanhoe for $345 million and reached an agreement to pay more than $1.36 billion in stages to acquire another 30 per cent.

The funds would provide Ivanhoe with enough cash to finance its flagship project at the Oyu Tolgoi copper and gold deposit in Mongolia.

Rio’s interest is a major shot in the arm for Ivanhoe and Oyu Tolgoi, especially since the Mongolian parliament passed a windfall tax measure that, at least for some investors, raised questions about the economics of the project.

“This gives Ivanhoe a lot more credibility than it had before,” said Ray Goldie, analyst with Salman Partners in Toronto.

Robert Friedland, Ivanhoe’s billionaire chairman and founder, owns 27 per cent of Ivanhoe’s stock. He described Rio’s investment as “the most significant event in the company’s 13-year history.”

Oyu Tolgoi “is probably the world’s largest undeveloped copper and gold deposit, hence our interest,” Rio Tinto spokesman Nick Cobban said by phone from London. “It fits our investment plans.”

“We have long believed that the right partnership would bring important benefits to the Oyu Tolgoi project, the people of the South Gobi region and all of Mongolia,” Friedland said in a release on Wednesday.

“We said in a formal statement three years ago that Ivanhoe was evaluating strategic partnerships with qualified companies that had relevant experience and resources to help ensure completion of a successful mining complex at Oyu Tolgoi. Today’s announcement marks the realization of that vision.”

Ivanhoe’s stock rose 31 per cent on huge volume following the announcement of the deal Wednesday. The shares closed on the Toronto Stock Exchange at $9.76, up $2.33. The stock is now up eight per cent on the year.

Rio Tinto shares were up $3.49 to $206.05 US on the New York Stock Exchange.

Ivanhoe’s shares came under intense pressure last May when Mongolia imposed a windfall tax after weeks of protests by demonstrators who set up tent camps, staged a brief hunger strike and burned effigies of Mongolia’s president and Friedland.

Ivanhoe’s board was initially shocked by the measure. But the company later noted the tax would be applied on the revenue earned from shipping copper and gold ore outside Mongolia for processing. Ivanhoe intends to process its ore within the country.

However, some uncertainty remains. Ivanhoe is still negotiating an investment agreement that would define the company’s tax and royalty relationship with the Mongolian government.

“The tax changes still haven’t been clarified,” Goldie said. “And we’re also still not clear what extent they’ll apply to whatever deal Ivanhoe gets.”

Rio Tinto wants Ivanhoe to sign a “stability agreement” with the Mongolian government within “much less than a year,” said Thomas Albanese, a Rio Tinto executive who will join Ivanhoe’s board of directors.

Rio has specific expertise with a cost-saving mining technique known as block caving. It’s a relatively tricky process, but it can cut costs, especially at a large project like Oyu Tolgoi.

Ivanhoe expects Oyu Tolgoi, which means Turquoise Hill, to produce one billion pounds of copper and 330,000 ounces of gold each year for 35 years.

Rio will buy another 9.95 per cent for $442 million if and when Ivanhoe negotiates an investment agreement with the government.

Rio has also acquired warrants that entitle it to pay another $920 million to up its stake to 33.35 per cent.

Finally, Rio has the right to buy another 6.6 per cent of Ivanhoe’s shares on the open market.

“The partnership significantly removes financing risk for the massive Oyu Tolgoi project,” said Tony Lesiak, analyst with UBS.

© The Vancouver Sun 2006