DEVELOPMENT I Downtown office space is hard to find because it’s more profitable to build residential

Derrick Penner

Sun

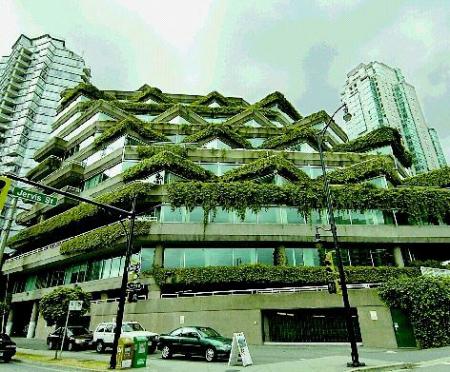

The Evergreen Building at 1285 West Pender in downtown will provide 81,000 square feet of vacant office space. Photograph by : Glenn Baglo, Vancouver Sun

The Evergreen building at 1285 West Pender St. is turning out to be an island of enterprise within the oasis of Vancouver’s so-called “resort city.”

Once slated for possible conversion to condominiums by previous owner John Laxton, the Evergreen is being resurrected by its new owner as office space: 81,000 square feet of empty rooms downtown, where the office vacancy rate is plummeting and spaces even half the size are scarce.

Potential tenants are circling.

“We’ve lost so much to residential [development] it has been unbelievable,” said Shawna Rogowski, a research associate in office leasing at the commercial realtor Colliers International. “So now, to gain something back, it’s great.”

By the City of Vancouver’s calculations, residential construction downtown has outpaced office construction since 1981. During the 2001-2005 period, downtown saw almost 12 million square feet of apartment towers built, compared with about five million square feet of office and retail buildings.

The Evergreen’s available office space won’t actually be back in circulation for another year as its new manager, Bentall Real Estate Services LP, refurbishes the interior of the unique Arthur Erickson-designed building.

However, by just being available as ‘Class A’ office space, the Evergreen caused a fractional uptick in Colliers International’s calculation of downtown Vancouver’s Class A office vacancy for the second quarter of 2006.

Representing just a blip in one class, it does nothing to halt the squeeze on city office space.

Colliers estimated downtown’s overall vacancy was at 4.7 per cent in the second quarter, down from 5.4 per cent in the first quarter.

Commercial realtor CB Richard Ellis estimated downtown’s vacancy slightly higher at 6.5 per cent, but their report’s author, senior research analyst Chris Clibbon, wrote that he expects the rate to continue to decline.

“With minimal new supply on the horizon, landlords find themselves in an enviable position,” Clibbon wrote. Companies, he predicted, will continue to move “back office” work to less-expensive suburban locations.

However, Vancouver’s Broadway corridor has an even lower office vacancy rate, at four per cent, according to the CBRE report. And rising rents in the district are inducing “sticker shock” among some potential tenants.

That pushes companies out even further. Burnaby has more availability, with 7.6 per cent vacancy, according to the CBRE report. Richmond’s availability, in a relative sense, is higher at 15.6 per cent, although its 3.2 million square feet of total office space is dwarfed by the 22 million square feet in downtown Vancouver.

In Surrey, the overall office vacancy rate is 18 per cent. In New Westminster it is 23.5 per cent.

Tony Astles, senior vice-president of Bentall Real Estate Services, said that for downtown Vancouver, any relief to the constraint in supply is still a long way off.

“[Vancouver is] not as tight as the Calgary market, but [office availability] has been on a steady decline for several years. At the same time, there has been an increasing amount of demand,” Astles said.

Bentall is managing the Evergreen building on behalf of the British Columbia Investment Management Corp., manager of the province’s public-sector pension funds.

Bentall, on behalf of another pension-fund client, is also in the process of completing one of the last purpose-built office towers to be built in the city, the 33-storey Bentall 5 on Burrard St.

Astles said the company used a “vertical phasing process” as a way of reducing the long timeframe for bringing a building to market.

The building’s second phase will bring 238,000 square feet onto the market, however Colliers’ Rogowski said much of that space has already been leased. Astles doesn’t believe Vancouver will see another purpose-built office tower until 2010 or 2011.

That is largely because condominium towers have offered landowners greater profits.

As a result, some old office buildings, such as the old B.C. Electric Building at Burrard and Nelson, were converted into condominiums, or saw office development mixed in with large components of residential construction, such as the Shaw Tower at Coal Harbour and the Hudson on Granville at Dunsmuir.

“Any site competes for use, and if you want to acquire a site, you have to be planning the highest and best use,” he added. If residential development offers investors a higher return, the best use winds up being condominiums.

In a broad sense, Astles added that no one disputes the benefits Vancouver has earned from building a strong downtown population. The city is a more vibrant place.

“Should we have saved some [land] for offices? Looking back with a bit of hindsight, maybe it would have been a good idea,” Astles said. “Looking forward, we’d better find ways to facilitate office development.”

Michael Gordon, senior planner for major downtown development for Vancouver, noted that there had been significant office development in the city. The Shaw Tower, with 278,400 square feet of commercial space, has more offices than condominiums.

Gordon said that of the almost five million square feet of non-residential construction downtown since 2000, almost 1.9 million has been office space.

The next significant downtown office on record with the city will be in the Jameson House building being developed at 830 West Hastings St., which will include 86,000 square feet of working space.

Gordon said the city is trying to make sure it provides for future office development, which is one of the reasons it has launched what it is calling a Metropolitan Core Jobs and Economic Review.

While opportunities to build offices downtown are limited, Gordon said, they do exist on Port of Vancouver lands along the Burrard Inlet waterfront, as well as to the east of Seymour St. The city’s goal is to make sure there are enough sites to last 25 to 30 years.

He hinted that the city has also been approached by developers interested in building new office space downtown.

“I would expect that in the next year or so, we would be entertaining a major development application,” Gordon said. “We’ll see a major new office building go into downtown.”

© The Vancouver Sun 2006