SCAMS: Crime, including identity theft, costs Canadians as much as $1.5 billion a year

Wendy McLellan

Province

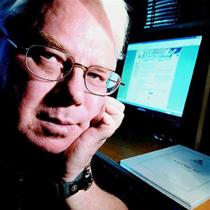

After 32 years at B.C.’s Land Titles office, Terry Dinnell now helps property owners monitor their land-title activity. Photograph by : Arlen Redekop, The Province

Runaway housing prices and a highly competitive mortgage industry are contributing to a growing problem with mortgage fraud across the country, experts say.

But it’s a complex issue — and one lenders don’t really want to talk about.

“Mortgage fraud is a problem, and I don’t think anybody can deny it,” said Ken Fraser, executive director of investigations for B.C.’s Financial Institutions Commission, which investigates fraud complaints involving mortgage brokers and real-estate agents.

“A lot of figures have been bandied back and forth over the years about the degree of it, but I don’t think anybody has a figure on it. It is definitely escalating.”

Mortgage fraud is any act that convinces a lender to grant a mortgage that would have been rejected if the truth were known. For instance, providing a letter of employment listing an inflated salary, or a note from a relative confirming a gift toward the down payment on a purchase when the money is really a loan.

This is known as “shelter fraud.” It happens when borrowers are trying to buy a home for which they don’t qualify.

In a hot real-estate market, these frauds are rarely detected and don’t result in a loss to lenders because the mortgages are repaid.

It’s “fraud for profit” that is a growing concern for lenders — and in some cases, innocent property owners are the victims.

In these instances, unscrupulous mortgage brokers, bankers, real-estate agents, lawyers or appraisers may use false appraisals to increase the value of a property.

They are able to sell it a few times through fake documents and get a mortgage for a far higher amount than the real value of the property, leaving the ultimate purchaser to pay the bills.

Or false documents or identities may be used to mortgage homes for marijuana grow-ops or crystal meth labs.

Criminals also can use identity theft to pose as the owner of a property at the provincial land-title office. They then are able take out a mortgage on the home or sell it to an innocent purchaser and make off with the proceeds.

Earlier this month, a Surrey woman pleaded guilty to mortgage fraud after posing as the owner of a vacant lot and taking out a $170,000 mortgage on the property. The mortgage was arranged through a mortgage broker but another broker figured out the scam and alerted police.

The fraudster was ordered to repay the Royal Bank for the mortgage as well as $2,500 to cover the costs of the elderly Vancouver woman who owned the land and had to fight to clear her title. Two other suspects are still before the courts.

“The problem with mortgage fraud is you’re dealing with identity theft,” said Barry Elliott, Ontario-based creator and coordinator of Phone-busters, a national police-sponsored call centre that tracks fraud.

“You can be victimized with a mortgage on your property and not be aware of it, or have property purchased in your name and not even know about it.”

Home computers can forge documents, and transactions are done by phone or fax, giving fraudsters more opportunities, Elliott said.

And financial institutions no longer send staff to physically check the property before completing mortgage documents.

“Nobody meets people anymore — everything is done electronically,” he said. “Institutions are fighting for mortgages — there is huge competition for business.”

Estimates of the extent of mortgage fraud in Canada range from $300 million a year to $1.5 billion — although most in the industry believe the real loss is closer to the lower figure.

Richmond resident Terry Dinnell recently retired after 32 years at B.C.’s Land Titles office and has set up a business for property owners who want to monitor activity involving their land title.

“Some people are worried about their property being taken from them, and some properties are more at risk than others,” said Dinnell, who operates Land Title Options as an online business.

He said vacant land and rental properties make better targets for criminal activity. Using a provincial database, Dinnell can monitor any B.C. property for activity — from new mortgages to builders’ liens — and notify owners. The service costs $21 for three months.

“We used to get lots of people asking for things the Land Titles office couldn’t offer,” said Dinnell. “Now that I’m retired, and I know the system is available, I thought I would try to offer it.”

Title-insurance companies, which sell policies to cover legal costs and losses when land titles are fraudulently transferred, say their business is rapidly growing. It’s difficult, however, to directly link the huge increase in policies to the incidences of title fraud, experts say.

B.C.’s land-title system makes it difficult for fraudsters to change ownership of a property. But there’s nothing to stop people from impersonating the rightful owner and registering a mortgage — or trying to sell the property — for profit.

In these instances, the lender that approved the mortgage on the strength of false documents is on the hook for the loss.

“It’s a relatively easy fraud to commit, and it happens more often than you think,” said Wayne Proctor, director of the Pacific Region of First Canadian Title, which sells title insurance policies. “A lawyer can make the case for the rightful owner and have the title reinstated, but it can be a lengthy and costly process.”

Premiums for title insurance usually taken out with the lender as beneficiary average $200 to $300 as a one-time charge. However, most industry experts say title fraud is not as big a concern as mortgage fraud involving organized groups intent on ripping off lenders by flipping properties to inflate values.

Vancouver lawyer Ron Usher said people have to be careful to protect their property. He suggests checking references and credentials of mortgage brokers, protecting personal identification and monitoring credit records. “Of course people need to be careful about their most valuable asset,” Usher said.

“Take time, do some due diligence to make sure you know what you’re doing.”

© The Vancouver Province 2006