Fiona Anderson

Sun

This 6,000-sq.-foot house on Eagle Mountain in Abbotsford is selling for $1,100,000.

The number of owners of million-dollar homes in B.C. will continue to climb as prices for real estate show no signs of abating, two economists say. But if prices maintain their rates of increase, Vancouver could experience a “real estate bubble,” says a third.

The recent run-up in prices has been caused by a healthy economy that has increased demand. At the same time, supply has not been able to keep up, Cameron Muir, senior market analyst with Canada Housing and Mortgage Corp. said.

As long as that demand-supply imbalance continues, prices will rise, Muir said.

“We still see listing inventories on the resale side being quite low, and new-home builders are working flat out to increase the housing stock, but it hasn’t been enough to achieve a balanced market in Greater Vancouver,” Muir said.

The same is true in the rest of B.C., where there are a limited number of listings, yet builders and developers are having trouble increasing the number of units they are building due to a shortage of land in some areas, and a lack of skilled labour throughout the province, Muir said.

As a result, Muir expects housing prices to continue to rise in 2006 at the same rate they did last year, which province-wide ranged between 11 and 15 per cent. But he said the rapid pace can’t continue indefinitely.

“If we had another four years like the last four years in terms of price appreciation, the average single detached home in Greater Vancouver would be worth $1.26 million,” Muir said. “That clearly would be unsustainable, and we expect prices to level off far before we reach that level.”

Helmut Pastrick, chief economist for Credit Union Central B.C., is also calling for price increases to continue, but at a slightly more moderate pace of 10 per cent this year and seven per cent in 2007.

“I’m looking for higher prices and higher sales and, in that sense, it’s not a slowdown,” Pastrick said. “But the rate of increase in prices I expect to slow.”

But Pastrick said he predicted the same slower rate of growth for 2005 and that didn’t materialize. But he believes more supply will come online, leading to some moderation in prices.

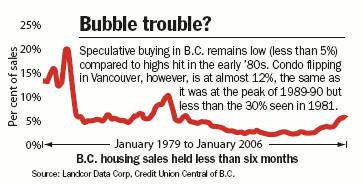

Pastrick would not rule out a possible market bubble, especially in certain sectors of the market. Bubbles are more likely when speculative buying is high, Pastrick said. He measures this by looking at the rate of “flipping,” selling a property within six months of purchasing it.

“When you see a lot of that, that’s when the bubble talk is more appropriate,” Pastrick said.

Pastrick said there has been an increase in flipping throughout the province recently, but it is still below levels in the past.

However, the Vancouver condo market shows more signs of speculation, with 10 to 12 per cent of sales being flips. That’s the same level as during the market peak of 1989-90, but less than the 30 per cent in 1981, Pastrick said.

Derek Burleton, senior economist at TD Bank, said if prices continue to climb at the rate they have been in Vancouver, there is a danger of a bubble.

the first quarter of 2006, house prices in Vancouver were up 22 per cent over the same period last year.

“That’s absolutely spectacular,” Burleton said.

TD believes that the Vancouver market is getting ahead of its underlying fundamentals.

“We would agree that economic fundamentals are strong in Vancouver but it still doesn’t add up to such rapid acceleration in home prices particularly as affordability erodes,” Burleton said. “So in our view the market is getting ahead of itself.”

TD is not forecasting a bubble, because there is no way of telling for sure if there is a bubble until after it has burst, Burleton said.

“But it’s a very heated market that needs to slow down. To the extent that prices don’t cool off, then the risk of a housing bubble is just going to rise further,” he said.

© The Vancouver Sun 2006