Vancouver home sales may slow, but prices expected to rise by 7%

Ashley Ford

Province

It will be the Lower Mainland and Western Canada leading Canada’s housing market next year, Royal LePage Real Estate Services said in its 2006 market forecast survey released yesterday.

The survey predicts no slowing in Greater Vancouver housing prices with an average rise of seven per cent to $469,700.

Across the Lower Mainland, sales are expected to slow somewhat, dropping 4.9 per cent to 39,950 units.

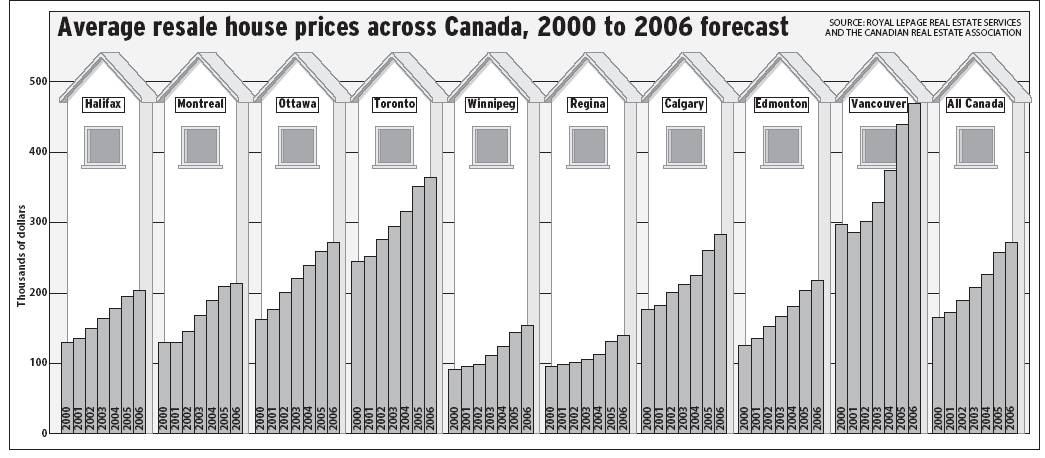

Nationally, average home prices will rise by six per cent to $271,800 in 2006, while the number of transactions is projected to fall by three per cent to 467,540, from this year’s anticipated record high of 482,000.

“Sustained job growth, rising wages and low interest rates will support a strong housing market in 2006,” said Bill Binnie, president of Royal LePage Northshore Vancouver.

A tight labour market will push wages higher in B.C. providing more capital for prospective buyers in the face of rising prices and interest rates keeping affordability at an acceptable level, he said.

Peter Simpson, CEO of the Greater Vancouver Home Builders’ Association said “crystal-ball gazing at the best of times is a very inexact science.

“But we don’t see any significant slowdown next year on the construction side and it will be another strong year for the industry.”

The vibrant western economies are highly unlikely to be derailed next year, especially if energy and commodity prices hold up.

B.C.’s Minister of Finance Carole Taylor believes all the economic fundamentals are in place for another strong year, but cautions in the latest financial Quarterly Report a faltering U.S. economy, rapid rise in interest rates and commodity price declines could slow economic growth.

But most believe the prosperity of the West will remain the driver of a strong housing industry next year.

B.C., Alberta and Saskatchewan will lead the charge, but the rest of the country will show more moderate growth, says Royal. Nevertheless, any demand or price relief will at best be marginal.

“Those looking for a break from the frenetic pace that has recently characterized the housing market will see some moderation next year, but the effects of an unusually strong fall market are expected to carry through into the first half of 2006, with the upward pressure on prices to continue in most areas of Canada,” Royal CEO Phil Soper said.

“While more balanced conditions are expected, as demand slows to meet supply, housing starts ease and the underlying Canadian economy continues to operate at near-full capacity, prices should rise in most regions,” he said.

Vancouver will continue its hold on the dubious title of most-expensive housing at $469,700, followed by Toronto at $364,000 and Calgary at $283,400.

The three most affordable cities will be Regina at $138,000, Winnipeg at $152,000 and Halifax at $202,800.

Montreal won’t see its affordability hammered by higher prices, and only a marginal increase of two per cent price to $213,180 is anticipated.

© The Vancouver Province 2005